Insurance is not about death. Insurance is about income continuity – ghar ka kharcha chalte rehna chahiye.

| Key Summary:

Your biggest asset is not your savings – it is your income. This blog explains why income protection is a basic financial need and how life insurance is the only long-term solution to protect that income. You’ll learn:

Key takeaway: Insurance is not about death. |

Your Biggest Asset is Invisible

Most people insure what they can see.

They insure their mobile phone, their car, and their house.

But they forget to insure the one thing that pays for all of this – their income.

This is where most financial planning quietly goes wrong.

A salary is not just monthly cash flow.

It is a future financial stream – money that has not yet come, but your family already depends on.

Sochiye zara. Agar kal se income ruk jaaye:

- children’s education plans get disturbed

- EMIs and household expenses don’t stop

- lifestyle takes an immediate hit

- long-term dreams slowly collapse

Sach yeh hai – savings help, but income runs the household.

Income is the engine. Everything else is secondary.

That is why income is your biggest asset, even though it is invisible.

Understanding Income Protection – The Real Meaning

Income protection is often misunderstood. Many people think income protection means:

- saving more money, or

- buying an investment-oriented insurance policy

In reality, income protection is far more basic.

Income Protection simply means:

- protecting the earning capacity of the breadwinner

- ensuring the family’s standard of living continues even after a shock

- safeguarding future income, not past savings

A simple way to understand this – jo har ghar samajh sakta hai:

- Income is financial oxygen

- Savings are stored oxygen

- Life insurance is the emergency oxygen cylinder

Agar income band ho jaaye aur income protection na ho:

Savings khatam hoti hain → assets bechne padte hain → lifestyle permanently downgrade ho jaata hai.

Income protection koi luxury decision nahi hai.

Yeh family ki basic zaroorat hai – jaise bijli, paani, aur ration.

Human Life Value (HLV) – The Missing Calculation

Before going further, one point must be very clear:

- Human Life Value is not a solution

- Human Life Value is not a product

- Human Life Value is not something to compare

HLV is a tool used to identify how much life insurance coverage is actually required.

What is Human Life Value?

Human Life Value represents the economic value of a person’s remaining working life.

In simple language:

HLV answers one basic question –“Agar main nahi raha, toh meri family ko kitni income chahiye hogi?”

Most people buy insurance randomly because they don’t know:

- how much cover is enough

- why a certain amount is chosen

- whether they are underinsured or not

HLV removes guesswork and replaces it with clarity.

Income is a Long-Term Asset

A working professional should be seen as a long-term income-generating asset.

Just like:

- a business that produces yearly cash flow

- a bond that gives predictable income

- a machine that generates output every year

A 35-year-old earning ₹12 lakh annually does not earn ₹12 lakh.

He earns ₹12 lakh multiplied by the number of years he will continue working.

Yeh soch badalte hi picture clear ho jaati hai.

Life insurance does not insure the person.

It insures the income pipeline that supports the family.

HLV Calculation – Logic First, Formula Later

HLV is not meant to scare people with mathematics. Its purpose is understanding – “kitna cover chahiye”, not complex calculations.

Conceptual Steps

Step 1: Current Annual Income

How much income the family depends on today.

Step 2: Remaining Working Years

Current age minus expected retirement age.

Step 3: Family Dependency Period

How long the family will rely on this income.

Step 4: Future Income Value

Annual income multiplied by remaining working years.

This gives a basic Human Life Value.

Advanced models may adjust for inflation or income growth, but the core logic remains unchanged – HLV quantifies income risk.

Why Most Indians Are Underinsured

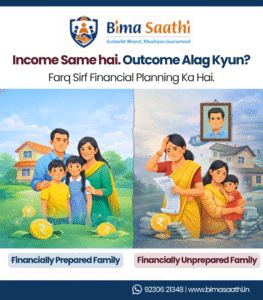

Underinsurance in India is not due to lack of money.

It is due to behaviour and mindset.

Common mistakes include:

- choosing insurance based on lowest premium

- mixing insurance with investment goals

- buying policies because “kisi ne bola tha”

- assuming employer insurance is enough

The biggest blind spot is this: People insure their loans, but ignore income replacement.

Loan khatam ho jaata hai.

Income loss ka impact decades tak rehta hai.

HLV as a Decision-Making Tool

HLV helps answer real, practical questions:

- How much life insurance cover do I actually need?

- Is ₹50 lakh enough, or should it be ₹1 crore or more?

- Am I properly protected or underinsured?

The flow is simple:

Human Life Value → Required Coverage → Life Insurance

HLV acts as:

- a planning compass

- an objective benchmark

- a rational alternative to emotional selling

Isliye HLV sirf number nahi, decision-making tool hai.

Income Protection Through Life Insurance

Now the connection must be stated clearly.

- Income protection is the need

- Life insurance is the only long-term solution

When life insurance pays out, it creates replacement capital.

This capital is meant to generate income for the family.

Instead of asking:

“How much insurance should I buy?”

A better question is:

“Agar main nahi raha, toh ghar ka kharcha kaise chalega?”

HLV converts this question into a clear coverage amount.

The Human Side of Human Life Value

HLV is not just a financial number.

It represents:

- children’s school and college fees

- household stability

- daily routines continuing normally

- family plans that don’t get cancelled

HLV is not about money alone.

It is about family dignity, stability, aur peace of mind.

Clearing a Common Misunderstanding

Human Life Value is not a comparison method.

It does not compete with other approaches.

It simply identifies the absolute value of protection required.

Once the need is identified, life insurance naturally becomes the solution for income protection.

Turning Understanding into Action

Every earning member should take these steps:

- Estimate remaining working years

- Identify annual family dependency income

- Calculate Human Life Value

- Review existing life insurance cover

- Identify the protection gap

- Use life insurance to bridge the gap

Yahi responsible financial planning hoti hai.

Common Myths About Income Protection

“I have investments, so I don’t need insurance.”

Investments build wealth; they don’t replace income immediately.

“My employer provides insurance.”

Job gayi, toh cover bhi gaya.

“Insurance is needed only till children grow up.”

Responsibilities khatam nahi hoti, sirf badalti hain.

“HLV is too complicated.”

Ignoring income risk is far more dangerous.

The Role of Term Insurance

HLV tells you how much protection is required.

Life insurance delivers that protection.

Term insurance is often the most efficient way to do this because it focuses purely on income replacement and long-term protection.

This is logic, not product pushing.

Why HLV Thinking Matters More Today

Modern families face:

- higher aspirations

- longer life expectancy

- long-term liabilities

- increasing financial responsibilities

Income protection is no longer optional.

HLV makes it structured, rational, and intentional.

Final Thoughts – Reframing Insurance

Your real net worth is not what you have accumulated.

It is the income your family is yet to receive.

The real question is not whether you have insurance – the real question is whether your income is truly protected.

Income once lost cannot be rebuilt.

But with the right thinking, it can be protected.

FAQs

What is Income Protection & Human Life Value?

Income protection replaces lost income temporarily, while Human Life Value measures lifetime earnings for insurance planning.

Why is Human Life Value important?

It helps calculate the correct insurance cover needed for your family’s future expenses.

Is income protection necessary if I have savings?

Savings are limited, while income protection provides structured monthly support.

Does Human Life Value change over time?

Yes, it changes with income growth, responsibilities, and life stages.

Can self-employed individuals use income protection?

Yes, income protection is especially important for self-employed professionals.

Leave A Comment