| Key Summary

Most working professionals think about earning extra income, but very few know what actually works alongside a full-time job. This blog breaks the myth that side income is either risky or unrealistic. With real examples, honest numbers, and simple logic, it explains when extra income along with a job is practical – and when it’s just hype. If you’re juggling EMIs, family responsibilities, and future goals, this piece helps you think clearly, without pressure or false promises. Because extra income isn’t about shortcuts – it’s about stability, patience, and smart choices. |

Salary Comes, Salary Goes

It’s the 1st of the month.

Salary credited.

You feel rich for roughly 3 hours.

Then reality starts pinging you like WhatsApp notifications:

- Rent

- EMI

- Electricity bill

- Credit card reminder

- School fees

- “Weekend plan?” (dangerous question)

By the 20th, the bank balance looks like it needs emotional support.

Paise kam nahi padte. Planning late ho jaati hai.

And that familiar thought returns:

“Can I earn some extra income along with a job… realistically?”

Not a jackpot.

Not overnight success.

Bas thoda sa cushion.

So, let’s answer this honestly – without motivational drama and without fake promises.

Why Extra Income is No Longer “Optional”

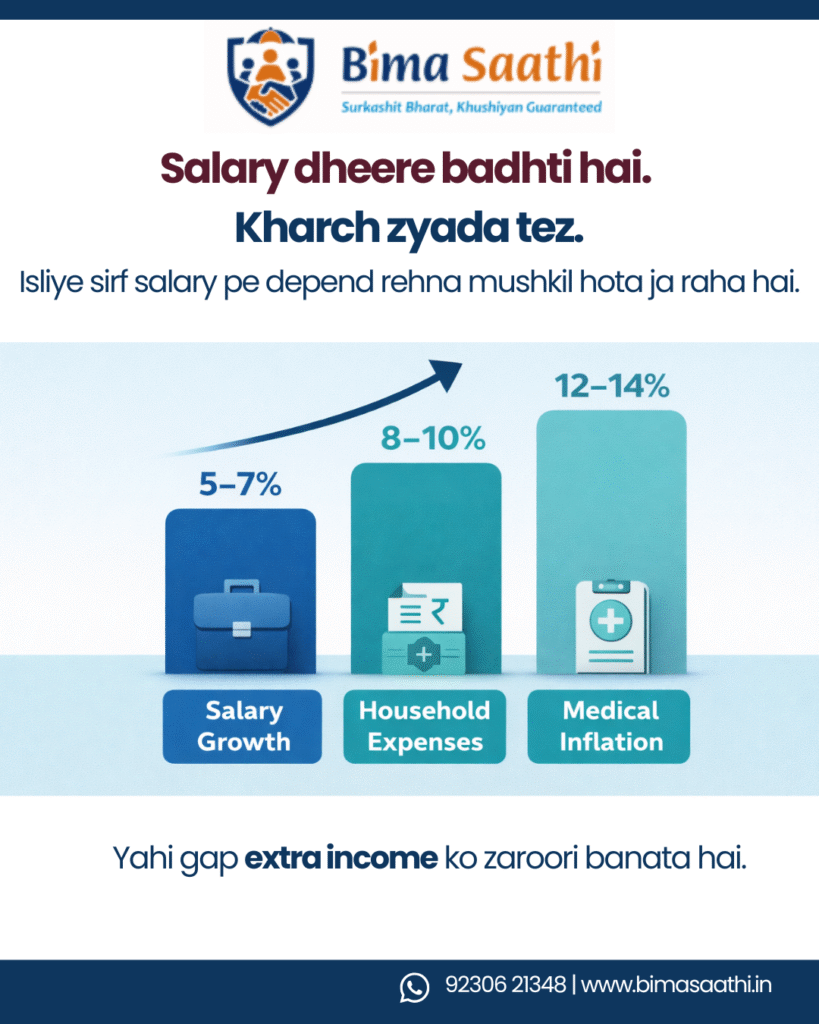

According to recent industry estimates:

- Average household expenses in India have increased by 8–10% annually

- Salaries, for most private employees, grow at 5–7% per year

- Medical inflation in India is around 12–14% annually

Translation?

Your expenses are running faster than your salary.

Ye sirf feeling nahi hai. Ye math hai.

That gap is why extra income along with a job has quietly moved from “nice to have” to necessary.

Why People Want Extra Income… But Don’t Start

Almost everyone wants extra income.

Very few actually start.

Why?

Fear #1: “Time kahan milega?”

After 9 hours of work, traffic, and family duties – energy feels like phone battery at 3%.

Fear #2: “Scam toh nahi?”

India has trained us well here. If someone says “easy money,” our brain screams RUN.

Fear #3: “Main sales type ka banda/bandi nahi hoon”

Good news: most successful side earners didn’t think they were either.

Reality Check: Most Side Hustles May Not be Job-Friendly

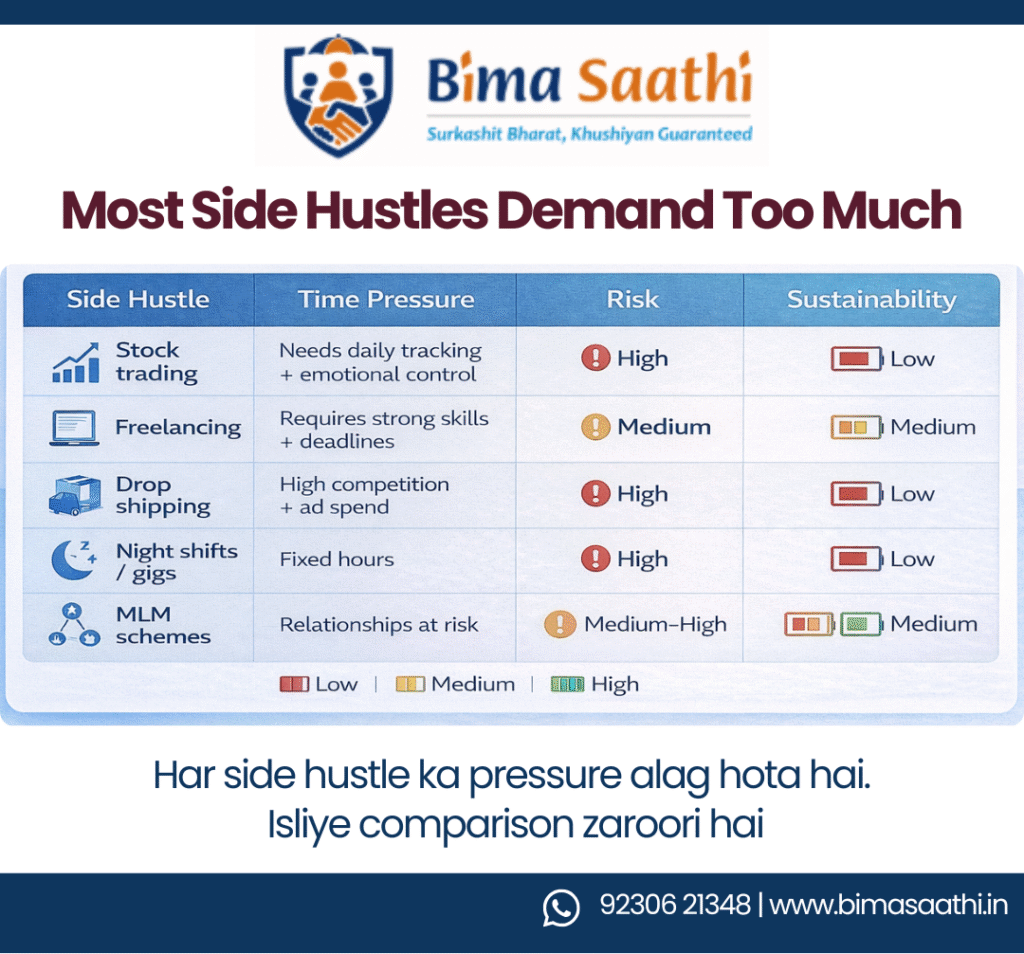

Let’s look at popular side income ideas and why they fail working professionals:

| Side Hustle | Reality |

| Stock trading | Needs daily tracking + emotional control |

| Freelancing | Requires strong skills + deadlines |

| Drop shipping | High competition + ad spend |

| Night shifts / gigs | Burnout guaranteed |

| MLM schemes | Relationships at risk |

That’s why many people quit after 2–3 months and declare: “Extra income is only for influencers and YouTubers.”

It’s not.

You just need the right model.

Side hustle ka pressure agar job se zyada ho, toh signal samajhna chahiye.

What Makes Extra Income Along with a Job Actually Practical?

Based on real working-life constraints, a side income works only if it ticks these 5 boxes:

Flexible Time

You should decide when you work.

Example:

- 30–60 minutes on weekdays

- A few hours on weekends

If someone says “daily 4 hours compulsory,” close the tab.

Low Financial Risk

According to surveys, over 70% of Indians hesitate to start side income due to fear of losing money.

That fear is valid.

A practical option:

- Starts with low or zero investment

- Grows with effort, not deposits

EMI ke upar EMI kisi ko nahi chahiye.

No Clash with Your Job

Side income should:

- Be legal

- Be transparent

- Not conflict with employer rules

Stress-free income > fast income.

Scalability Over Time

₹10,000 extra per month is good.

₹15,000–₹30,000 extra over time is better.

If income doesn’t grow with experience, motivation dies.

Social Respect & Trust

In India – especially Tier II & III cities – trust is currency.

Extra income ka test simple hai: kya ye aapki life ko easier banata hai?

People prefer work that sounds like:

“Achha kaam hai”

Not

“Ye kya naya chakkar hai?”

Why Insurance-Based Side Income Fits These Rules

Let’s clear one myth first.

Modern insurance work is not:

- Standing outside offices

- Forcing relatives

- Chasing targets

Today, it’s about guidance and awareness.

And here’s why it fits perfectly as extra income along with a job:

Constant Demand

- Over 60% of Indians are still underinsured

- Health insurance penetration is improving, but awareness is still low in small towns

Demand exists. Knowledge gap exists.

Conversations, Not Shifts

Most interactions happen:

- On phone calls

- On WhatsApp

- After office hours

No punching in. No boss yelling “Where are you?”

Local Trust = Big Advantage

Example:

If a stranger explains insurance → doubt.

If you explain insurance → trust.

India mein log pehle aadmi dekhte hain, product baad mein.

“Isko toh jaante hain” is the biggest sales tool here.

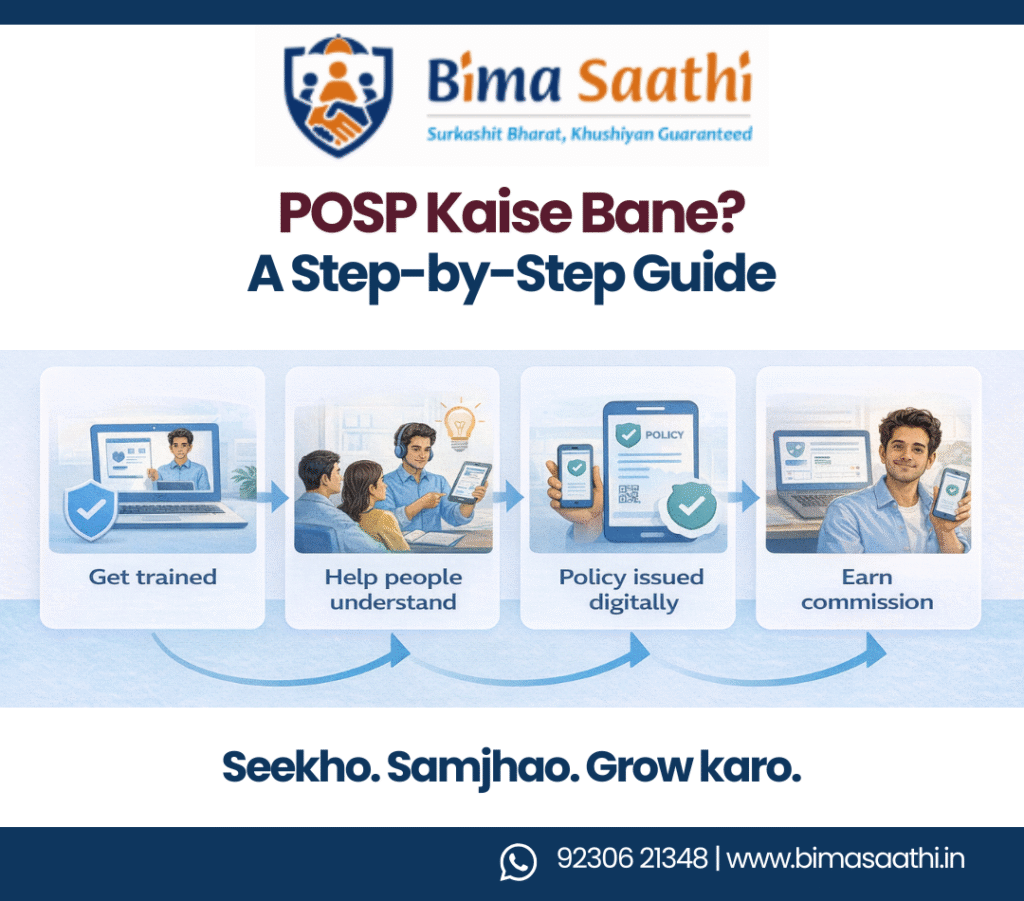

The POSP Model: Designed for Working Professionals

POSP (Point of Sales Person) is a regulated, certified model where:

- You get trained

- You help people understand insurance

- You earn commissions

Most people start:

- Part-time

- Alongside a full-time job

- With minimal cost

No office politics. No appraisal meetings.

Realistic Income: Let’s Put Numbers on the Table

Honesty matters.

In the first 2–3 months:

- Income may be ₹10,000–₹12,000/month

With consistency (6–12 months):

- ₹15,000–₹30,000/month is achievable for many

Some earn more. Some less.

Income depends on:

- Effort

- Network

- Time invested

- Willingness to learn

No magic. No lottery. Just compounding.

Jo dheere badhta hai, wahi zyada din chalta hai.

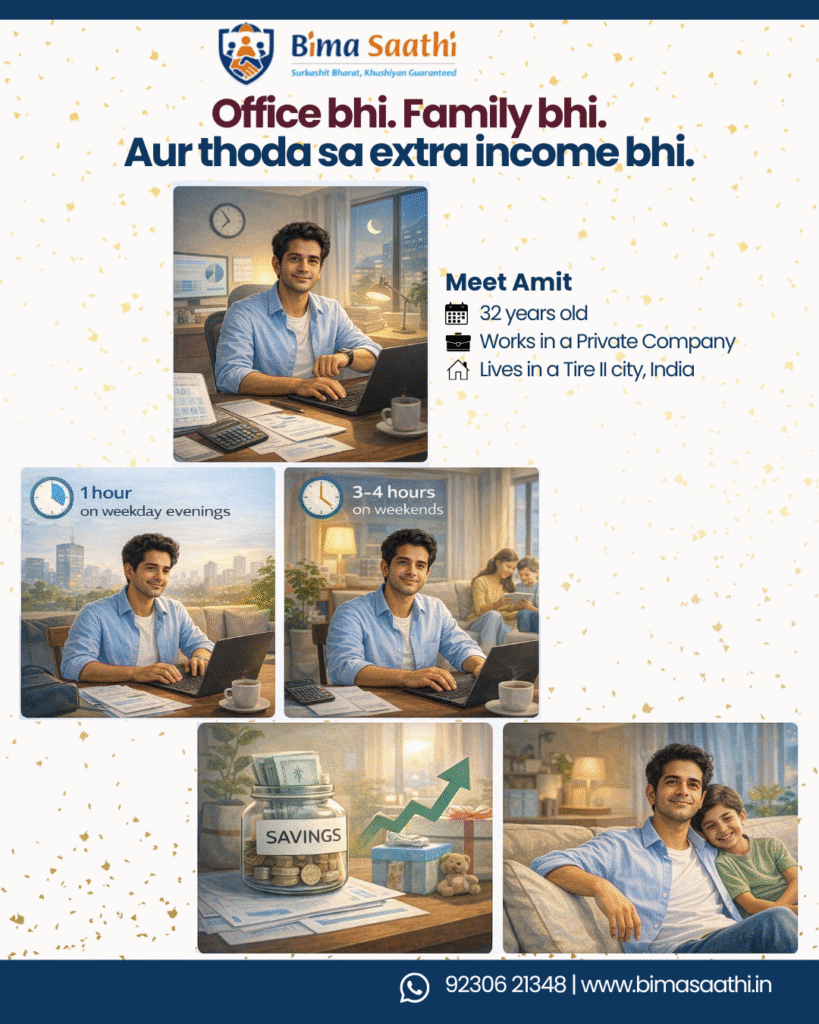

A Simple Real Life

Meet Amit.

- 32 years old

- Works in a private company

- Lives in a Tier II city

He spends:

- 1 hour on weekday evenings

- 3–4 hours on weekends

In 6 months:

- He covers basic household bills with extra income

- Salary stays untouched for savings

Not glamorous.

But very powerful.

Kyunki security kabhi glamorous nahi hoti. Par zaroori hoti hai.

Why Starting Still Feels Hard

Common thoughts:

- “Log kya sochenge?”

- “Mujhse hoga ya nahi?”

- “Failure ka darr”

Truth?

Every financially stable person once felt the same.

Extra income isn’t about ego.

It’s about options.

Options give confidence.

Final Thoughts: Dream or Practical Reality?

Extra income along with a job is absolutely practical.

But only when:

- Expectations are realistic

- Risk is low

- Time is flexible

- Growth is gradual

- Work builds trust, not stress

It’s not a dream.

It’s a decision.

Sometimes, that decision changes how secure the future feels.

Aur jab soch clear ho, toh extra income sirf possible nahi – practical ho jaata hai.

FAQs

1. Is extra income along with a job legal in India?

Yes. It is legal as long as it follows employer policies and government regulations.

2. How much extra income can a salaried person realistically earn?

Most salaried professionals earn ₹10,000–₹30,000 per month depending on time, effort, and the model chosen.

3. Can extra income really fit into a busy job schedule?

Yes. Flexible, part-time models that require a few hours a week are designed for working professionals.

4. Is insurance-related side income risky?

No. When done through regulated and certified models, it is low-risk and effort-based.

5. How long does it take to see results from side income?

Most people see initial results within 2–3 months, with meaningful income building over 6–12 months.

Leave A Comment