| Key Summary

A modern insurance career in India is no longer about aggressive selling – it’s about guiding families with clarity, integrity, and long-term responsibility. The real difference between a salesperson and a Saathi lies in mindset: one pushes policies, the other builds trust. In today’s evolving insurance ecosystem, especially across Tier II and Tier III India, sustainable income comes from relationships, not pressure. |

If you search online for a modern insurance career in India, you’ll mostly see two types of content:

- “Earn unlimited income!”

- “Work from home, high commission, quick growth!”

Sounds exciting, right?

But let’s pause for a second.

Agar sab itna easy hota, toh har doosra insaan insurance millionaire hota.

The truth is simple:

Insurance is not about fast selling.

It is about long-term guiding.

And that is where the real difference lies – Salesperson vs Saathi.

In today’s evolving insurance ecosystem, especially across Tier II and Tier III India, the profession is changing. It’s becoming more skill-driven, trust-led, and dignity-based.

Let’s break it down.

The Reality of the Insurance Industry in India

Before we compare Sales vs Saathi, let’s understand the context.

- India’s insurance penetration is around 4% of GDP (IRDAI data range).

- In many Tier II and Tier III cities, life and health insurance awareness is still growing.

- Over 70% of India’s population lives outside metro cities.

This means:

✔ Huge opportunity

✔ Growing awareness

✔ But also – low trust due to past mis-selling

Insurance does not suffer from lack of products.

It suffers from lack of clarity and trust.

That’s why the idea of a modern insurance career in India must evolve.

Traditional Sales Mindset: Short-Term Game

Let’s talk honestly.

The old-school insurance sales mindset looked like this:

- “Target kitna hai?”

- “Policy close kab hogi?”

- “Customer ko convince kaise karein?”

- “Month-end aa gaya, jaldi karo!”

Focus:

- Close fast

- Push harder

- Maximize commission

And sometimes (not always, but often), this led to:

- Over-promising returns

- Hiding limitations

- Creating fear-based urgency

Short-term spike mil sakta hai.

But long-term reputation? Risky.

In insurance, one wrong promise can destroy years of trust.

Insurance is not like selling a mobile phone.

Policy replace nahi hoti. Regret hota hai.

Saathi Mindset: The Modern Insurance Career Approach

Now let’s look at the Saathi mindset.

In a modern insurance career in India, the professional is not just a seller – but a guide.

A Saathi:

- Explains before recommending

- Listens before speaking

- Clarifies before closing

- Thinks long-term, not month-end

Salesperson asks: “Deal kab close hogi?”

Saathi asks: “Kya yeh decision sach mein aapke liye sahi hai?”

Big difference.

Why the Modern Insurance Career in India Demands a Saathi Approach

Today’s customers are smarter.

- They Google before meeting you.

- They compare policies online.

- They read reviews.

- They ask questions.

Especially middle-class salaried parents, small business owners, and first-time buyers – they want clarity, not pressure.

According to multiple consumer behavior studies in BFSI:

- Trust is the #1 decision factor in financial product purchase.

- More than 60% of customers prefer advisors who explain both benefits and limitations clearly.

Translation?

Convincing is outdated. Explaining is powerful.

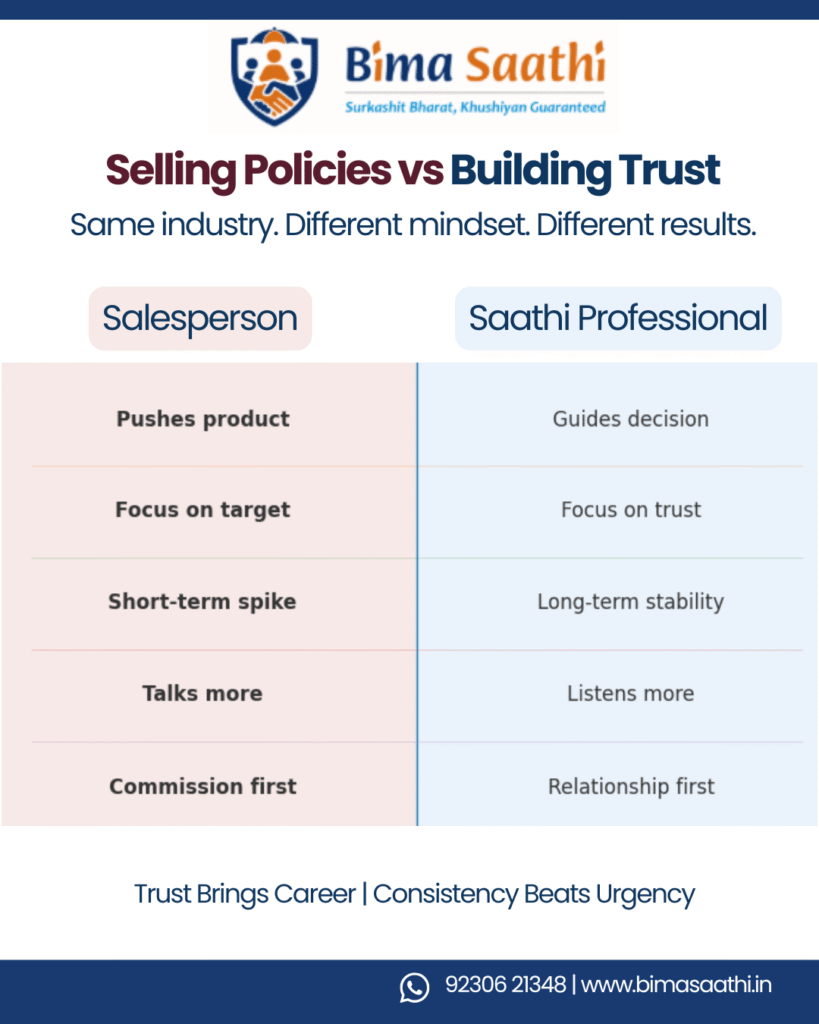

Salesperson vs Saathi: Side-by-Side Comparison

| Traditional Salesperson | Saathi Professional |

| Pushes product | Guides decision |

| Talks more | Listens more |

| Focus on commission | Focus on relationship |

| Creates urgency | Creates clarity |

| Short-term spike | Long-term stability |

| Transaction mindset | Responsibility mindset |

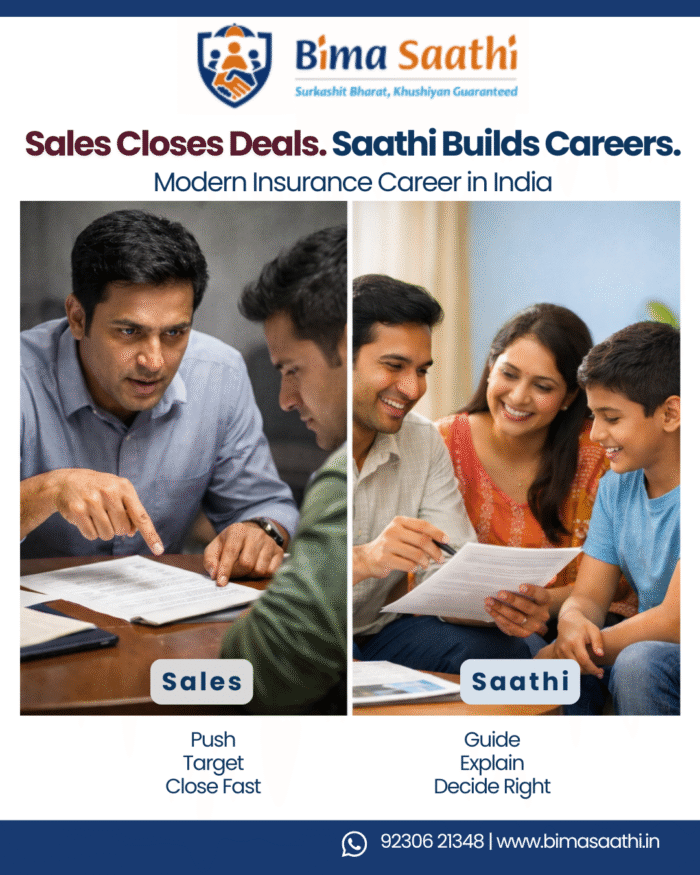

Sales closes deals.

Saathi builds careers.

Income Reality: Let’s Talk Honestly

One of the biggest questions in a modern insurance career in India is:

“Kitna kama sakte hain?”

Fair question.

Here’s the truth:

- Insurance income is performance-linked.

- It depends on effort, consistency, and skill.

- It is not fixed salary-based in many POSP models.

Some professionals build strong monthly income over time.

Some struggle due to inconsistency or poor guidance.

What makes the difference?

Not personality.

Not luck.

Not jugaad.

Skill + Attitude + Behavior.

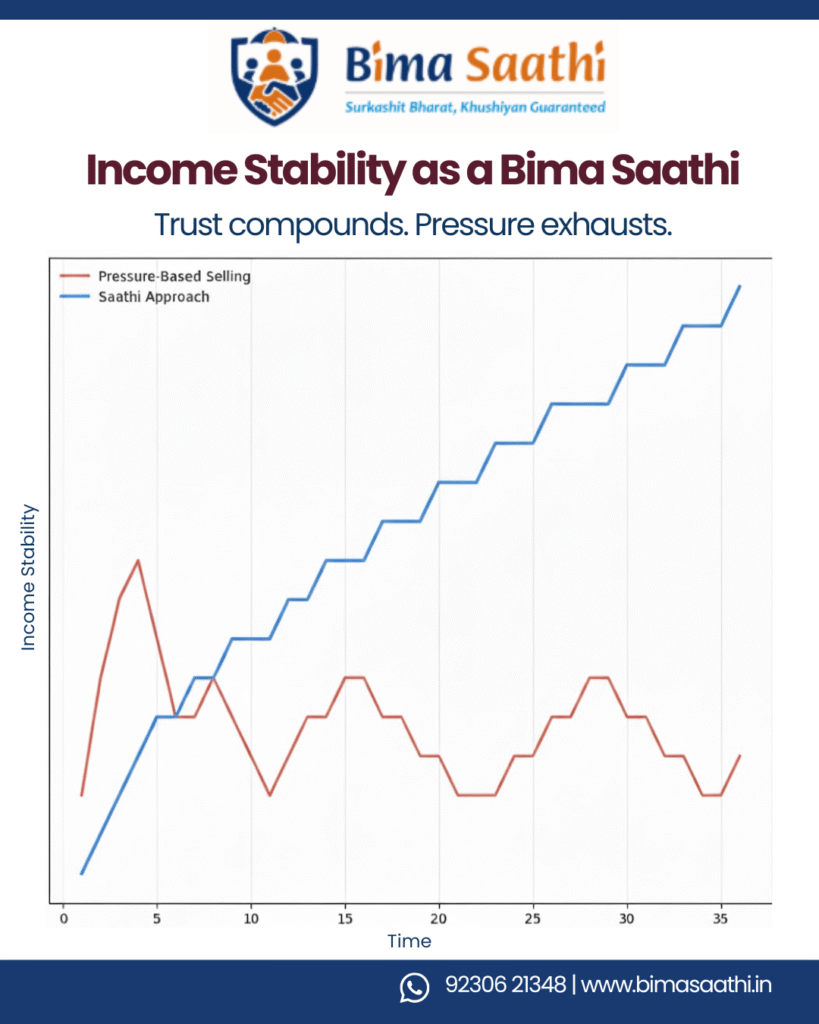

And here’s something interesting:

Professionals who build repeat customers and referrals often grow faster in 2–3 years than those who chase only cold selling.

Why?

Because:

Trust compounds.

Pressure exhausts.

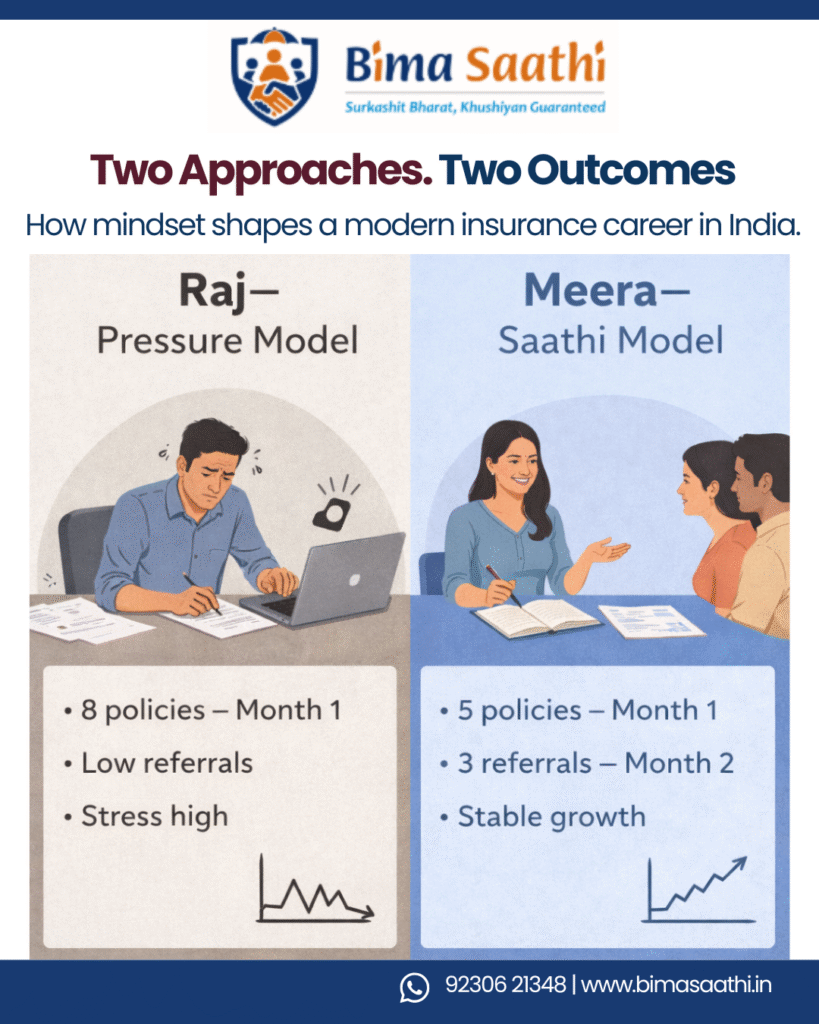

Two Different Career Paths

Let’s imagine two insurance professionals.

Raj – Traditional Sales Style

- Focus: Close quickly

- Tactic: “Sir, aaj hi lena zaroori hai.”

- Result: 8 policies in 1 month

- Month 2: Customers stop responding

- Referrals: Low

Income graph: Spike → Drop → Stress

Meera – Saathi Style

- Focus: Understand family needs

- Tactic: “Aap thoda family ke saath discuss kar lijiye.”

- Result: 5 policies in 1 month

- Month 2: 3 referrals

- Month 3: Repeat conversation

Income graph: Stable → Growing → Sustainable

Punchline:

Slow clarity beats fast pressure. Har baar.

The Psychological Shift: From Seller to Professional

A modern insurance career in India is not about being “salesy.”

It is about being:

- A responsible advisor

- A calm explainer

- A long-term relationship builder

In fact, insurance professionals with a guiding mindset report:

- Lower burnout

- Higher referral rates

- Better self-respect

Aur haan – ghar pe bhi respect badhta hai.

Because jab aap logon ko secure karte ho, sirf policy nahi bechte.

Why Tier II & Tier III India Needs Saathis

In smaller cities and towns:

- Reputation spreads faster than advertisements.

- Word-of-mouth matters more than social media ads.

- Trust is community-based.

If you mis-sell, poora mohalla jaanta hai.

But if you guide honestly?

Community support milta hai.

That’s why a modern insurance career in India, especially outside metros, must be trust-led.

Skill-Based Growth, Not Aggressive Selling

Insurance success is built on 7 core skills:

- Trust building

- Need discovery

- Simple explanation

- Responsible presentation

- Ethical objection handling

- Calm closing

- Follow-up discipline

None of these require aggression.

They require:

- Patience

- Emotional stability

- Professional pride

Insurance is not loud marketing.

It is quiet responsibility.

Insurance career without training = Gym membership without exercise.

Card toh mil gaya. Body kab banegi?

Similarly:POSP ID mil gaya. Skill kab banegi?

Modern insurance professionals invest in learning continuously.

Because:

Jo samjha nahi sakta, woh bech nahi sakta.

Jo sirf bechta hai, woh tik nahi sakta.

The Long-Term Advantage of Being a Saathi

Over 3–5 years, a Saathi-style professional builds:

- Strong referral network

- Repeat customers

- Stable monthly income flow

- Community trust

- Personal brand reputation

And most importantly:

Peace of mind.

Because no hidden promises = no future regret.

Final Thought: Choose Your Identity Carefully

Insurance can be:

- A stressful sales chase

OR - A respected professional journey

Difference product mein nahi hai.

Difference approach mein hai.

A modern insurance career in India belongs to those who:

- Value clarity over cleverness

- Value dignity over desperation

- Value long-term growth over month-end panic

Sales log policy bechte hain.

Saathi log zimmedari nibhaate hain.

Aur yaad rakhiye:

Commission temporary hota hai.

Reputation permanent hoti hai.

FAQs

Q1. What is a modern insurance career in India?

A modern insurance career in India focuses on trust-based advisory, skill development, and long-term relationship building rather than aggressive selling.

Q2. Is insurance a stable career option in India?

Insurance can become a stable career if approached with consistency, training, and a relationship-driven mindset.

Q3. How much can I earn in a modern insurance career in India?

Income depends on effort, skill, and customer retention. Earnings are performance-linked and grow sustainably with trust-based selling.

Q4. Do I need prior sales experience to start an insurance career?

No prior sales experience is mandatory. However, communication skills, willingness to learn, and ethical conduct are essential.

Q5. Why is trust important in an insurance career?

Trust determines referrals, repeat business, and long-term success in the insurance profession.

Leave A Comment