A Practical Guide for Those Exploring POSP or Insurance Jobs

| Key Summary

An insurance career is not about pushing policies – it’s about building trust. It requires communication skills, patience, integrity, and a long-term mindset. Income is performance-linked, and growth depends on consistency and responsibility. If you are ready to guide families calmly, avoid false promises, and think beyond short-term gains, this profession can become meaningful and sustainable. Insurance is not just earning – it is standing beside people when they need it most. |

If you’ve searched:

- “POSP kaise bane?”

- “Insurance job work from home”

- “Part-time income insurance”

- “Insurance career in India safe hai kya?”

- “Insurance me kitna kama sakte hain?”

You’re not alone.

Every year, thousands of Indians explore the insurance industry – some for a full-time career, some for part-time income, and some because they want flexible earning options.

But before joining, a more important question is:

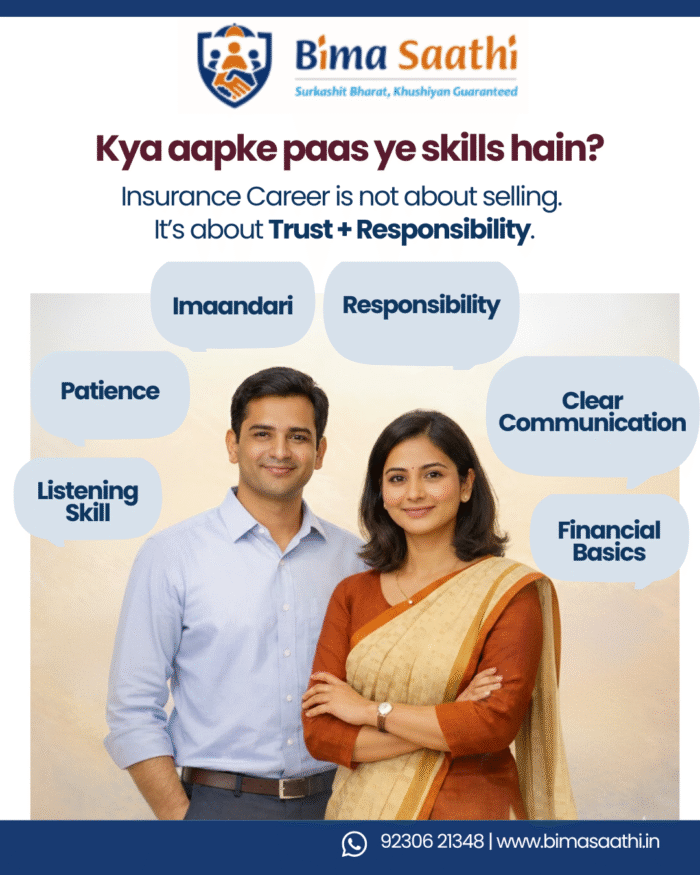

Do I have the right skills and mindset for an insurance career?

Because insurance is not just about selling policies.

It’s about trust. Aur trust ek din mein nahi banta.

Let’s understand everything step by step.

What is an Insurance Career in India?

An insurance career means helping individuals and families protect themselves financially against risk.

This may include:

- Life insurance (family protection)

- Health insurance (medical expenses)

- Motor insurance

- Business insurance

India’s insurance penetration is still around 4–5% of GDP, lower than many developed countries. That means:

- Many families are still underinsured.

- Awareness is growing.

- The opportunity exists – but so does responsibility.

Insurance advisors, POSPs (Point of Sales Persons), and agents act as guides.

Yeh sirf policy bechne ka kaam nahi hai – yeh zimmedari ka kaam hai.

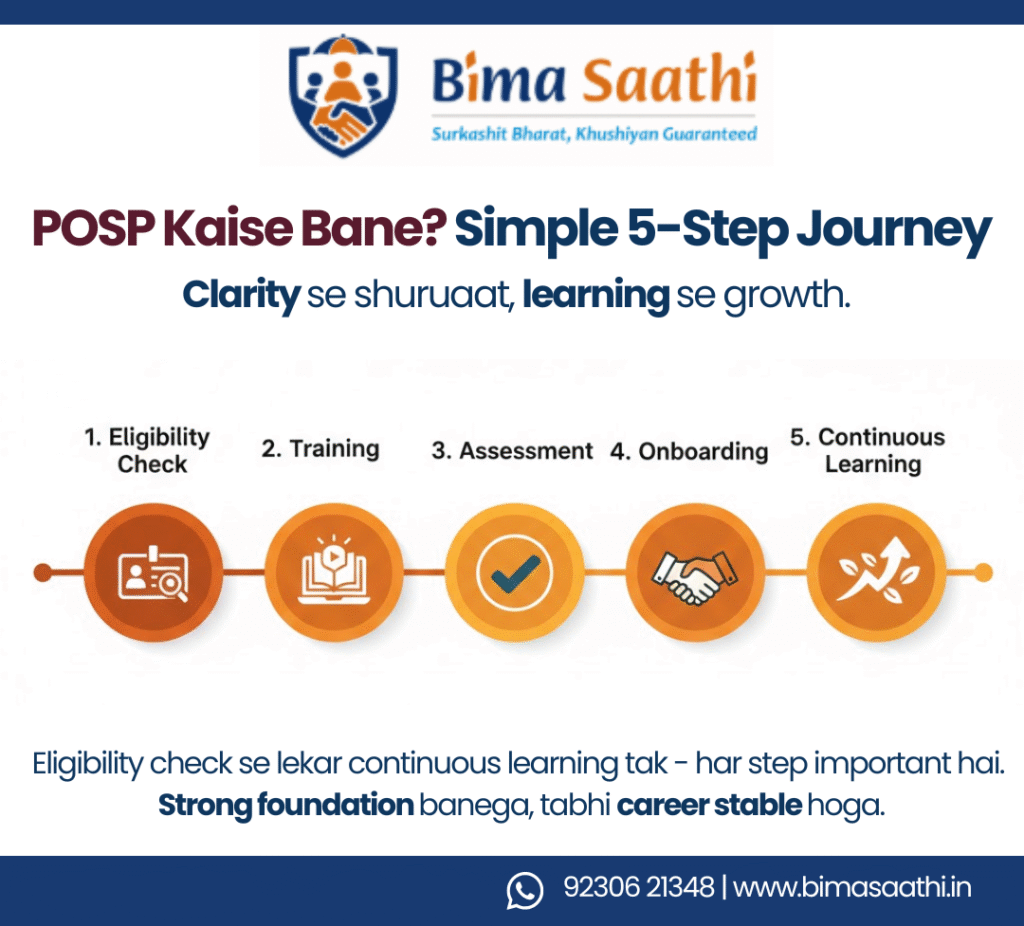

Step-by-Step: POSP Kaise Bane?

The exact process may vary slightly, but typically it follows these steps:

- Check Eligibility

- Minimum age: 18 years

- Class 10th pass

- Valid Aadhaar and PAN

- Clean record

- Complete Mandatory Training

You undergo structured training covering:

- Basics of insurance products

- Ethical selling practices

- Documentation process

- Claims understanding

Training is not a formality. It builds your foundation.

Jitni strong foundation, utna stable career.

- Clear Assessment

After training, there is usually a basic assessment to ensure understanding.

- Onboarding

Once approved, you can begin sourcing policies through the authorized broker/company.

- Continuous Learning

The most successful insurance professionals:

- Upgrade their product knowledge

- Improve communication skills

- Learn digital tools

- Understand customer psychology

Insurance is a long-term profession. Learning never stops.

Skills Required for a Successful Insurance Career

Let’s talk honestly about what really matters.

- Clear Communication

You don’t need fluent English.

You need clarity.

For example:

Instead of saying:

“This plan provides structured wealth optimization.”

Say:

“This plan gives insurance cover plus investment, but returns depend on market performance.”

Simple explanation builds confidence.

Log confusing English se nahi, clarity se impress hote hain.

- Listening More Than Talking

Many people think insurance is about convincing.

Actually, it’s about listening.

A customer may worry about:

- Children’s education

- Hospital bills

- Loan repayment

- Family security

If you don’t listen carefully, you cannot advise responsibly.

- Integrity and Honesty

This is non-negotiable.

Never:

- Promise guaranteed returns where none exist

- Hide waiting periods

- Downplay exclusions

- Exaggerate benefits

Short-term sales through misinformation may happen.

But long-term reputation will suffer.

Insurance mein credibility hi aapka real asset hota hai.

- Basic Financial Understanding

You don’t need advanced finance knowledge.

But you must understand:

- What is term insurance?

- What is a deductible?

- What is a waiting period?

- How premium is calculated?

- Difference between fixed and market-linked returns

Knowledge builds authority – calmly, not aggressively.

- Patience and Consistency

In the first 6–12 months, many new advisors go through a learning curve.

Not every meeting converts.

Not every lead responds.

Those who succeed:

- Follow up respectfully

- Maintain relationships

- Ask for referrals politely

- Stay consistent

Yeh sprint nahi hai. Yeh marathon hai.

- Documentation Discipline

Insurance is documentation-heavy.

Incorrect forms or incomplete KYC can create claim problems later.

If a claim gets delayed due to paperwork error, the family suffers.

That’s why discipline matters.

- Emotional Stability

Rejections are part of the journey.

It’s not personal.

If 10 people say no, one may say yes.

Professional maturity means staying calm and respectful.

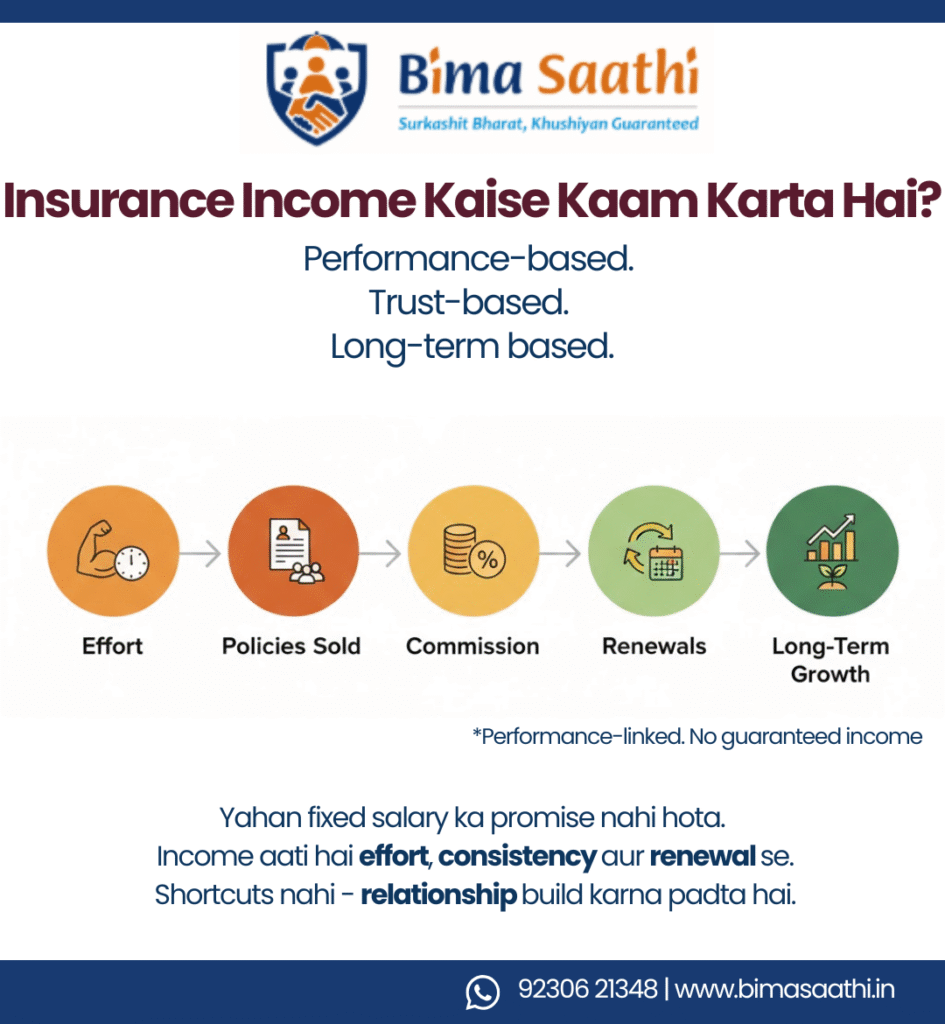

Income in Insurance: Realistic Explanation

The most searched question:

“Insurance me kitna kama sakte hain?”

Here is the honest answer.

Insurance advisory income is usually:

- Commission-based

- Performance-linked

- Dependent on product type and premium size

There is generally:

- No guaranteed fixed salary in advisory roles

- No assured monthly income initially

- Income variability in early stages

For example (illustrative only):

If someone sources:

- 10–15 policies per month

- With average annual premium ₹15,000–₹25,000

Their earnings will depend on the commission structure applicable.

Over time, renewal commissions can create recurring income.

But remember:

Insurance income grows with trust, consistency, and retention – not shortcuts.

These are probability-based patterns, not income guarantees.

Is an Insurance Career Safe?

Safety depends on three factors:

- Regulatory Framework

Insurance in India operates under a regulated environment. That provides structural stability.

- Ethical Practice

If you:

- Stay transparent

- Avoid misleading claims

- Explain risks clearly

Your long-term risk reduces significantly.

- Long-Term Thinking

If you join for quick money, frustration may follow.

If you join with service mindset, growth becomes sustainable.

Short-term greed weakens career. Long-term trust strengthens it.

Can Insurance Be Done Part-Time?

Yes.

Many people start part-time, including:

- Homemakers

- Teachers

- Small business owners

- Retired professionals

- Working individuals seeking additional income

But part-time does not mean casual responsibility.

You still need:

- Proper training

- Customer servicing

- Documentation accuracy

- Availability during claim support

Flexibility exists. Responsibility remains constant.

Also Read: Who Can Become a BIMA SAATHI?

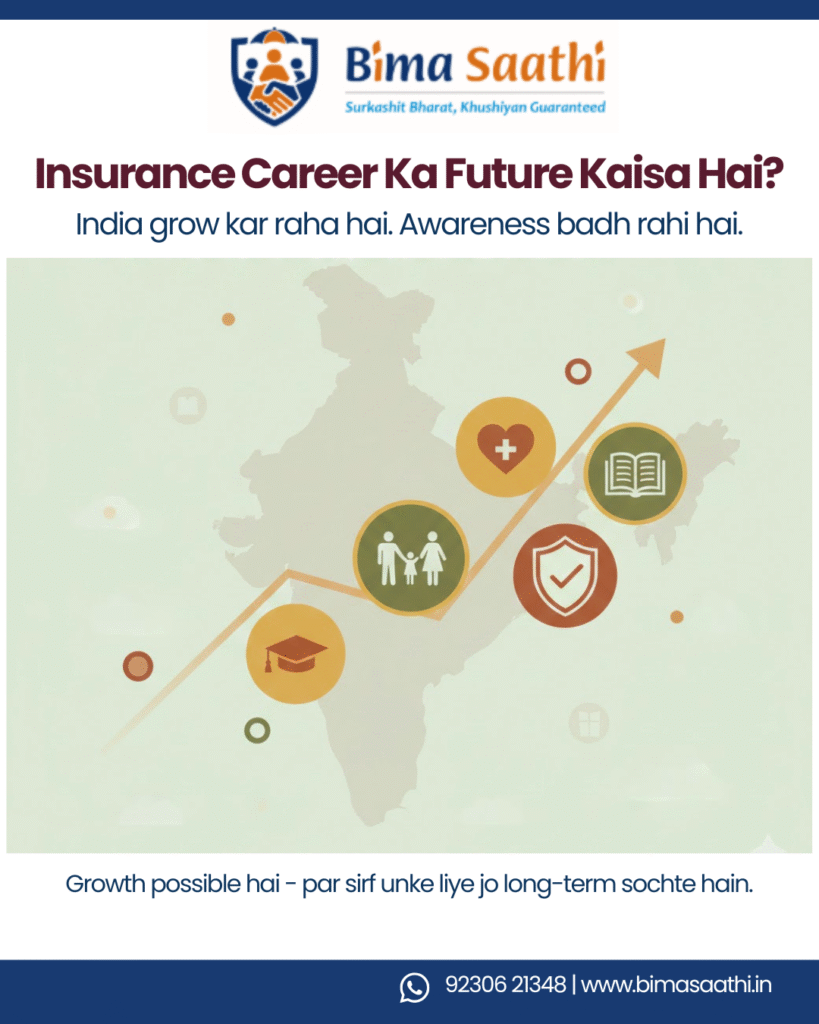

Future Scope of Insurance Career in India

India has:

- A young population

- Rising healthcare costs

- Growing middle class

- Increasing awareness post-pandemic

Health insurance demand has increased significantly in recent years. Term insurance awareness is also improving.

Technology is digitizing processes, but human advisors remain important because:

- Insurance decisions are emotional.

- Claims require guidance.

- Families need reassurance.

Future belongs to professionals who:

- Use digital tools

- Maintain human trust

- Focus on service, not pressure

The growth outlook is positive in probability terms – not guaranteed outcomes.

Also Read: Insurance Career in India: More Than Sales. A Saathi’s Responsibility

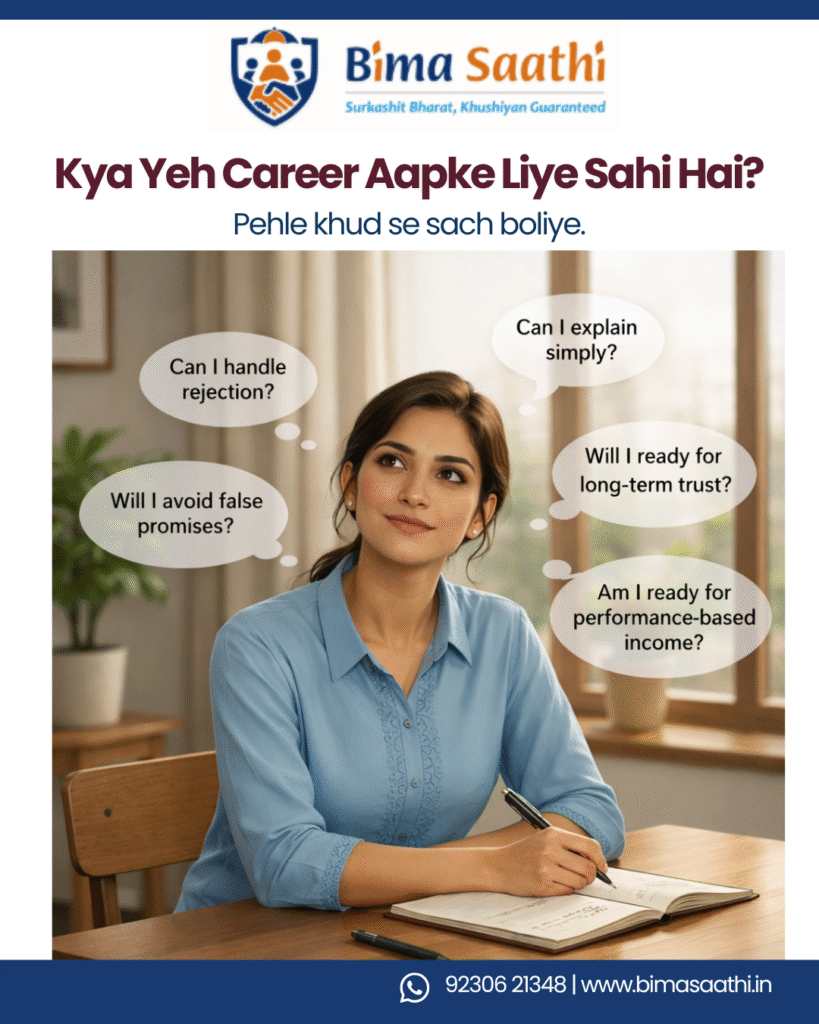

Self-Check: Is This Career Right for You?

Ask yourself honestly:

- Can I explain financial products simply?

- Can I stay patient during rejection?

- Am I comfortable earning performance-linked income?

- Will I avoid misleading customers even if it costs a sale?

- Do I genuinely want to help families secure their future?

If most answers are “yes,” this career may align with you.

If your only focus is “fast money,” this may not be the right path.

Common Myths About Insurance Career

Myth 1: Only aggressive people succeed.

Reality: Calm, trustworthy advisors often perform better long term.

Myth 2: Income is always high and fixed.

Reality: It depends on effort, consistency, and retention.

Myth 3: Only sales professionals can do it.

Reality: Many successful advisors come from teaching, small business, homemaking, and service backgrounds.

A Soft Reflection

Insurance is not glamorous.

It doesn’t give instant fame.

But when a family receives financial support during a crisis because of a policy you helped arrange – that impact is real.

Kabhi kabhi career sirf earning ka nahi, meaning ka bhi hota hai.

If you are exploring insurance as a career, take your time.

Understand the model.

Prepare your skills.

Think long-term.

Your growth will depend on your integrity more than your pitch.

Final Thought

Insurance career is not about convincing people.

It’s about standing beside them when life becomes uncertain.

Aur jab aap kisi ke saath khade rehte ho – tabhi aap sach mein “saathi” bante ho.

Choose wisely. Grow responsibly.

FAQs

Q1. How can I become a POSP in India?

You need to meet eligibility criteria, complete mandatory training, clear assessment, and onboard with an authorized insurance broker or company.

Q2. Is insurance career good for part-time income?

Yes, it can be pursued part-time, but income is performance-linked and requires consistent effort.

Q3. Is insurance job safe in India?

The sector operates under regulatory oversight. Career stability depends largely on ethical practice and long-term mindset.

Q4. How much can I earn in insurance?

Earnings vary based on commission structure, number of policies sourced, and retention. There is no guaranteed income.

Q5. What skills are required for insurance career in India?

Communication, listening ability, integrity, basic financial knowledge, patience, documentation discipline, and emotional resilience.

हिंदी में पढ़ें → Click Here

Leave A Comment