| Key Summary

Thinking about starting an insurance career in India? This step-by-step guide explains everything clearly – from eligibility and certification to skill development and income reality. Insurance is not a shortcut to quick money, but a long-term, trust-based profession. With the right training, consistency, and ethical approach, it can become a stable and meaningful career option for students, homemakers, and working professionals. |

If you have ever searched “How to Start an Insurance Career in India”, chances are you’re looking for:

- Flexible income

- A stable long-term career

- Low investment entry

- Or simply… ek strong career restart

Good news? You’re not alone.

India’s insurance industry is growing fast. As per IRDAI reports, India’s insurance penetration is around 4% of GDP, which means the market is still massively under-served. That’s not a weakness – that’s opportunity.

And here’s the reality:

Insurance is not just a job. It’s a responsibility profession.

“Policy bechna kaam hai. Par suraksha samjhaana zimmedari hai.”

Let’s break down exactly how to start an insurance career in India, step-by-step – without confusion, without hype.

Why Consider an Insurance Career in India?

Before we talk steps, let’s talk clarity.

Massive Growth Opportunity

- India has over 1.4 billion people

- Life insurance penetration is still below developed markets

- Tier II and Tier III cities are under-served

- Rising awareness after COVID-19

The industry includes:

- Life insurance

- Health insurance

- Motor insurance

- General insurance

- SME & business protection

The demand is real. Families want protection. Business owners want continuity. Young earners want security.

Insurance is no longer optional. It’s essential.

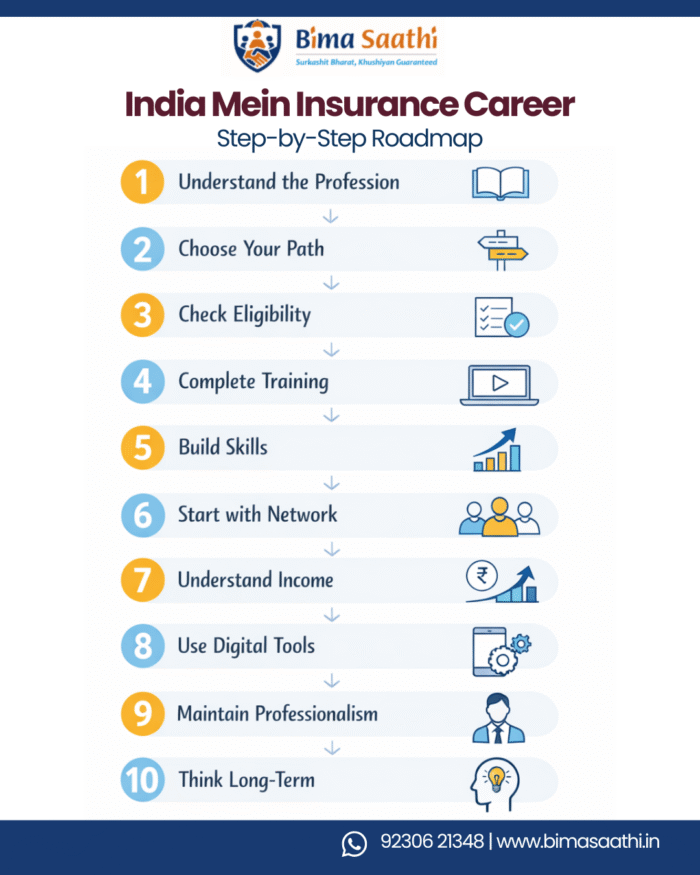

Step 1: Understand What an Insurance Career Actually Means

When people search “How to Start an Insurance Career in India”, many imagine:

❌ Door-to-door selling

❌ Forcing policies

❌ Commission chasing

Let’s correct that.

A modern insurance professional is:

✔ A guide

✔ A financial protection advisor

✔ A long-term relationship builder

You don’t “push plans”.

You understand needs.

You recommend protection responsibly.

“Convince karna zaroori nahi. Samjhaana zaroori hai.”

Step 2: Choose Your Path in the Insurance Industry

There are multiple entry routes.

Option 1: POSP (Point of Sales Person)

This is one of the fastest and most accessible ways to start.

- Low entry barrier

- Flexible working hours

- Suitable for students, homemakers, professionals on break

- Work independently or with an insurance broker

POSP certification is mandated through training and exam as per regulatory norms (handled by authorized intermediaries).

Option 2: Insurance Agent (Tied to a Specific Insurer)

You work directly with one insurance company.

You represent their products only.

Option 3: Corporate / Full-Time Sales Role

You can join as:

- Relationship manager

- Sales executive

- Business development officer

This is a salaried route with targets.

Option 4: Agency Development Officer (Advanced Level)

If you grow in the ecosystem, you can eventually:

- Recruit other advisors

- Train them

- Build a team

- Multiply your impact

But first – focus on becoming capable.

Step 3: Check Eligibility & Basic Requirements

If you’re wondering how to start an insurance career in India, here are the basic eligibility factors:

- Minimum age: 18 years

- Educational qualification: Typically 10th or 12th pass (varies by role)

- Basic documentation (PAN, Aadhaar, bank account)

- Willingness to undergo training and certification

That’s it.

No MBA required.

No fancy degree needed.

Sirf sincerity aur discipline chahiye.

Step 4: Complete Mandatory Training & Certification

Insurance is regulated in India. That’s a good thing – it protects customers and professionals.

As a POSP or agent, you must:

- Complete prescribed training hours

- Clear a certification exam

- Get registered through authorized channels

Training usually includes:

- Insurance basics

- Types of policies

- Customer needs understanding

- Ethical selling guidelines

Important:

Choose a platform or organization that focuses on skill development, not just recruitment numbers.

Because here’s the truth:

Untrained advisors struggle.

Trained advisors grow sustainably.

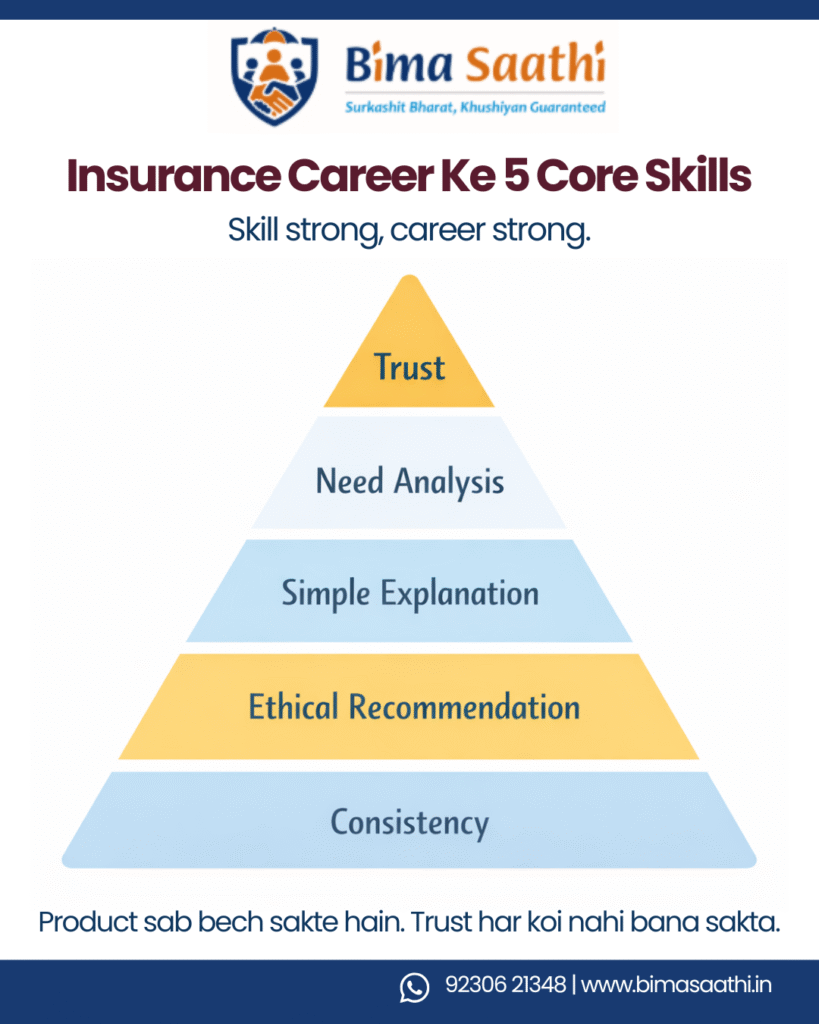

Step 5: Build Core Skills (This is Where Real Success Happens)

Many people start. Few sustain.

Why?

Because insurance success is skill-based, not luck-based.

Here are 5 core skills you must develop:

1️. Trust Building

People buy insurance from people they trust.

Simple.

2️. Need Analysis

Ask questions like:

- “Aapki family mein financial responsibility kaise divided hai?”

- “Agar income ruk jaaye toh kitne months manage ho paayega?”

Listen more than you speak.

3️. Simple Explanation

If you cannot explain a plan in simple words, you don’t understand it enough.

“Jargon se impression nahi banta. Clarity se trust banta hai.”

4️. Ethical Recommendation

Never present something as “guaranteed” or “perfect”.

No plan is universal.

Context matters.

5️. Consistency

Insurance income builds over time.

Renewals + referrals = long-term growth.

Step 6: Start With Your Natural Network

When learning how to start an insurance career in India, don’t begin with strangers.

Start with:

- Friends

- Relatives

- Neighbors

- Local business owners

Not to sell aggressively – but to practice conversations.

Your first goal is confidence, not conversion.

Step 7: Understand Income Reality

Let’s be practical.

Income in insurance depends on:

- Effort

- Skill

- Consistency

- Network

- Product mix

There is no fixed salary in independent models like POSP. Earnings are commission-based and vary.

Initial months may be slow. That’s normal.

However, over time:

- Renewals create recurring income

- Referrals reduce acquisition effort

- Experience improves conversion quality

Insurance rewards patience.

“Yeh sprint nahi hai. Yeh marathon hai.”

Step 8: Leverage Digital Tools

Today’s insurance career is not offline-only.

You can use:

- WhatsApp for communication

- Video calls for consultations

- CRM tools for tracking follow-ups

- Social media for awareness

India has over 800 million internet users. Digital literacy is growing even in Tier III cities.

Digital + human trust = powerful combination.

Step 9: Maintain Professional Behavior

Your long-term success depends on attitude.

Never:

❌ Mislead

❌ Hide limitations

❌ Use fear tactics

❌ Overpromise income

Always:

✔ Respect every customer

✔ Admit when you need clarification

✔ Follow up responsibly

✔ Think long-term

Remember:

One wrong sale can damage years of reputation.

Step 10: Think Beyond Selling – Think Impact

When you start an insurance career in India, you are entering a profession that:

- Protects families

- Secures children’s education

- Supports medical emergencies

- Stabilizes small businesses

Insurance is invisible until it is needed.

But when needed, it becomes priceless.

“Policy ka importance tab samajh aata hai jab mushkil waqt aata hai – aur tab aap yaad aate ho.”

That’s responsibility.

Who Should Consider Starting an Insurance Career?

This field is especially suitable for:

- Homemakers seeking flexible income

- Students wanting practical experience

- Retired professionals wanting relevance

- Small business owners seeking secondary income

- Salaried individuals looking for a side stream

If you value:

- Independence

- Relationship-building

- Long-term growth

- Community respect

Insurance can be a meaningful path.

Common Myths About Starting an Insurance Career in India

❌ Myth 1: “Insurance mein sirf pushy log succeed karte hain.”

Reality: Calm, patient, ethical advisors succeed long-term.

❌ Myth 2: “Income unstable hoti hai.”

Reality: Initial income varies. Long-term renewals stabilise earnings.

❌ Myth 3: “Log mana kar dete hain.”

Reality: Rejection is part of every profession. Skill improves outcomes.

Even cricketers don’t score every ball.

Toh phir hum kaise har conversation close karein?

Final Thoughts: Is Insurance the Right Career for You?

If you’re searching “How to Start an Insurance Career in India”, ask yourself:

- Do I enjoy helping people understand things?

- Am I patient enough to build trust?

- Can I stay consistent even when results are slow initially?

If yes – this career can be powerful.

Not flashy.

Not overnight-rich.

But dignified. Stable. Impactful.

“Kamai ke saath izzat mile – toh career strong hota hai.”

Insurance gives you both – if done responsibly.

If you want to understand whether this path suits your personality and goals, the best next step is not “joining immediately” – it is having a clear conversation and asking the right questions.

Career decisions should be informed.

Because jab future secure karna ho – toh decision bhi responsible hona chahiye.

FAQs

Q1. What is the minimum qualification to start an insurance career in India?

Most entry-level roles like POSP require you to be at least 18 years old and have basic educational qualification such as 10th or 12th pass.

Q2. How much can I earn in an insurance career in India?

Income depends on your effort, skill, and consistency. It is commission-based in many roles and varies from person to person.

Q3. Is certification mandatory to start an insurance career in India?

Yes. You must complete required training and clear certification through authorized channels before selling insurance products.

Q4. Can I start an insurance career part-time?

Yes. Many professionals, students, and homemakers start as POSPs or agents on a flexible, part-time basis.

Q5. Is insurance a good long-term career option in India?

Yes. The industry is growing, awareness is increasing, and long-term renewals can create sustainable income when built ethically and consistently.

Leave A Comment