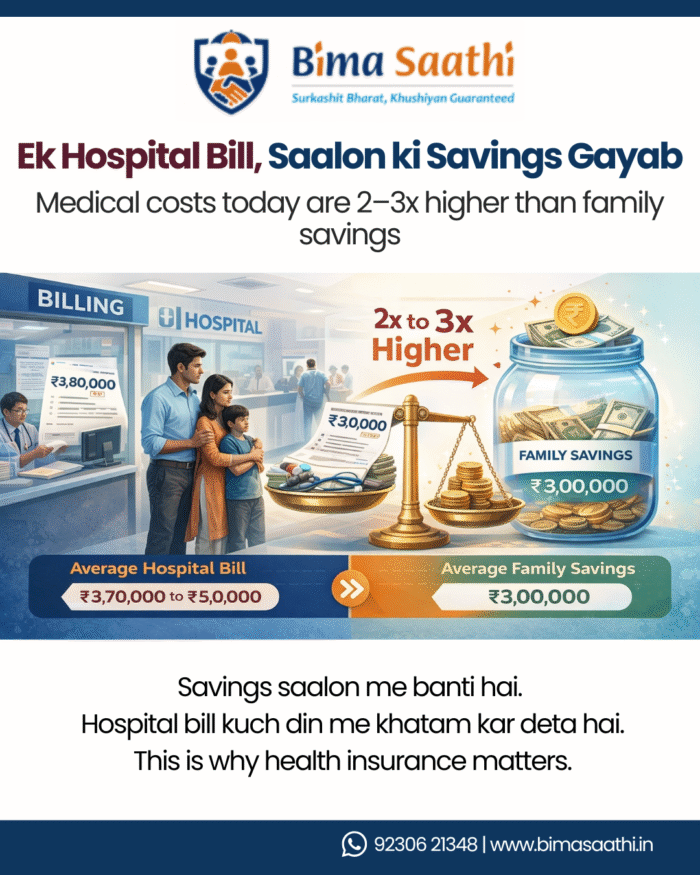

“₹5 lakh ka bill ban gaya hai.”

For many Indian families, this one sentence is enough to change everything.

Despite rising hospital costs, only about 1 in 3 Indians has health insurance.

A single medical emergency can quietly wipe out years of savings, fixed deposits, gold, and even force families into debt. And this is not a rare story anymore – it’s becoming a middle-class reality across India, especially in Tier-II and Tier-III cities.

Health insurance is often discussed, advertised, and ignored. But when the bill finally arrives, people realise – “Kaash pehle socha hota.”

The Reality of Hospital Costs in India Today

Medical inflation in India has been rising steadily. Treatment that once cost a few thousand rupees now runs into lakhs, especially in private hospitals.

Here are some realistic hospital cost examples that families face today:

- Normal delivery: ₹40,000 – ₹1.5 lakh

- C-section delivery: ₹1 lakh – ₹2.5 lakh

- Appendix or gall bladder surgery: ₹80,000 – ₹2.5 lakh

- ICU charges (per day): ₹15,000 – ₹0,000

- Heart bypass surgery: ₹3 – ₹8 lakh

And this is only the hospital bill.

Add medicines, follow-up tests, travel, food, and income loss – and the total impact is much higher.

For a middle-class household earning ₹25,000 – ₹50,000 per month, such expenses are not just stressful – they are financially devastating.

Middle-Class Vulnerability: Too Rich for Help, Too Poor for Shock

The Indian middle class lives in a dangerous gap.

- Not poor enough to get full government support

- Not rich enough to absorb medical shocks

Most families do have some savings – but those savings are meant for:

- Children’s education

- Marriage

- Building a home

- Retirement

When a medical emergency hits, these plans collapse overnight.

“Savings toh thi, par emergency ke liye nahi.”

That’s the harsh truth.

People often rely on:

- Breaking FDs

- Selling gold

- Taking high-interest loans

- Borrowing from relatives

In India, nearly 60% of healthcare expenses are still paid out of pocket. That’s why savings meant for education, marriage, or retirement vanish during emergencies.

Health insurance is not just about medical bills – it’s about protecting life goals.

“Hum Toh Healthy Hain”: The Most Common Mistake

One of the biggest reasons people delay health insurance is mindset.

- “Abhi toh hum young hain”

- “Kabhi hospital jaana hi nahi pada”

- “Dekhenge baad mein”

But health emergencies don’t come with warnings.

Accidents, infections, lifestyle diseases, and sudden complications can affect anyone – at any age.

Medical costs are rising at 12–14% every year, while income grows at 6–8% – almost double the rate of income growth.

The most expensive lesson is learning about health insurance after the emergency.

Why Awareness is Still Low in Small Towns

In metro cities, conversations around insurance are slowly improving. But in small towns and Tier-II/ Tier-III cities, awareness is still alarmingly low.

Why?

Because insurance is not just about information – it’s about understanding.

Over 70% of insured Indians have health cover of ₹10 lakh or less.

People struggle with:

- How much cover is enough

- What policies actually include

- What to trust and what to avoid

Websites, ads, and policy documents exist – but they don’t answer real questions in simple language.

Insurance is not complicated. It is made complicated.

The Real Gap: No One Explains It Properly

Here’s the truth most people won’t say out loud:

Health insurance awareness is still low because there aren’t enough trained people at the local level.

People don’t need more ads.

They need someone who can sit with them and explain:

- “Iss plan ka matlab kya hai”

- “Iss situation mein kaam karega ya nahi”

- “Aapke family ke liye kya sahi hai”

Someone who speaks their language.

Someone they trust.

And that is where the system is failing today.

When Awareness is Low, Risk is High

Because of low awareness:

- Families remain uninsured or under-insured

- People buy policies they don’t understand

- Claims become stressful instead of supportive

The result?

Health insurance becomes a distress purchase, not a protection plan.

Millions of households spend over 10% of their annual income on healthcare.

And the irony is – most families actually want to do the right thing. They just don’t know how.

A Growing Need Across Cities and Towns

India is seeing:

- Rising healthcare costs

- Increasing lifestyle diseases

- Growing nuclear families

- Less financial backup

At the same time, local guidance is missing.

That’s why today:

This is why insurance advisors are in demand across cities and towns.

Not corporate salespeople.

Not call-center voices.

But local, trained advisors who understand:

- The people

- The problems

- The realities of middle-class life

In small towns especially, trust matters more than anything. And trust always comes from people, not platforms.

Someone who can explain without pressure and guide without confusion.

The Bigger Picture

Every hospital bill tells two stories:

- A family that wasn’t prepared

- A system that didn’t educate enough

Health insurance matters – not just because hospitals are expensive, but because life is unpredictable.

And as awareness grows, the need for people who can guide others responsibly is only increasing.

Final Thought

Ek hospital bill sirf ek expense nahi hota.

It can erase years of hard work in one moment.

Health insurance is no longer optional – it’s essential.

A treatment costing ₹2 lakh today can cost approximately ₹3.5 lakh in just five years at 12% inflation.

In a country where understanding is still low, those who can explain clearly, honestly, and locally are becoming more important than ever.

This is not just about protection.

It’s about being the bridge between risk and security.

FAQs

Q1. Why is health insurance important in India?

Health insurance is important in India because hospital costs are high and medical emergencies are unpredictable. A single hospital bill can wipe out years of savings for middle-class families. Health insurance protects both health and financial stability.

Q2. How much does hospital treatment cost in India?

Hospital treatment in India can cost anywhere from ₹80,000 to several lakhs in private hospitals. Even common procedures like deliveries or surgeries can be financially stressful. Medical inflation is rising faster than most household incomes.

Q3. Can a single hospital bill wipe out savings?

Yes, one hospital bill can wipe out years of savings, especially for middle-class families. ICU stays, surgeries, and emergency treatments are extremely expensive. Isi liye financial planning without health insurance is risky.

Q4. Why is health insurance awareness low in small towns?

Health insurance awareness is low in small towns because there are not enough trained people to explain it properly. Policies are often confusing, and people do not get simple, local guidance. Samajh na hone ki wajah se log decisions delay kar dete hain.

Leave A Comment