| Key Summary

Extra income in today’s India means security, not luxury. With rising medical bills, increasing education costs, and growing job uncertainty, depending on a single income has become risky. Extra income helps families stay prepared, handle emergencies calmly, and reduce financial stress – “taaki kal kuch ho jaaye, toh life ruk na jaaye.” Even a small additional income can create stability, confidence, and that priceless feeling of peace of mind. Because honestly, sukoon bhi ek financial goal hi hota hai. |

Extra Income is No Longer Optional

In today’s India, the term extra income sounds simple, almost casual.

Like something you’ll think about “jab time milega.”

But for most Indian families, it carries a much deeper meaning.

It is no longer about earning a little more for vacations or lifestyle upgrades.

It is about security, preparedness, and that quiet inner relief – “haan, agar kuch ho gaya toh manage ho jaayega.”

Earlier, one stable job felt enough.

Today, even a stable job comes with an invisible asterisk.

And that is the real meaning of extra income in India today.

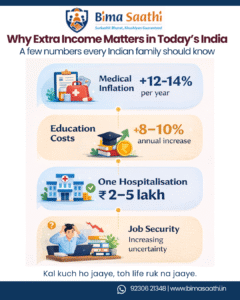

Key Numbers That Explain Why Extra Income Matters in India

Let’s pause emotions for a moment and look at some numbers – because numbers don’t lie… they just quietly scare you.

- Medical inflation: 12–14% annually

- Hospitalization cost: ₹2–5 lakh in private hospitals

- Education inflation: 8–10% annually

- Emergency fund gap: Most families can manage only 3–6 months

Put simply:

Expenses are running a marathon.

Income is jogging… sometimes with a limp.

The Reality Indian Families Are Living With

Let’s be honest.

Most Indian households are not careless with money.

They plan. They budget. They compromise.

They postpone that new phone and stretch the old one for “one more year”.

But the reality around them has changed.

- Medical inflation in India is estimated at 12–14% annually. One hospitalization can cost ₹2–5 lakh, even for something “routine”.

- Education expenses rise every year by 8–10%, often faster than salary increments.

- Daily living costs – rent, fuel, groceries – quietly increase without asking permission.

- Job security is no longer guaranteed, even for skilled professionals.

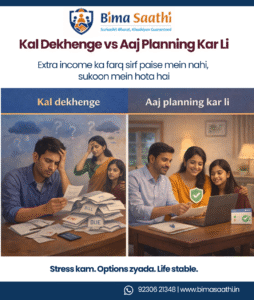

So even when everything looks fine on the surface, there is a thought that stays in the background:

“Ek income par sab kuch dependent hai.”

And that thought creates anxiety – the kind that doesn’t show on spreadsheets, but keeps you awake at night.

Extra Income Means Different Things to Different People

An extra ₹10,000 per month may not sound big.

It won’t change your lifestyle overnight or show up as a luxury upgrade on Instagram.

But numbers tell a different story.

₹10,000 per month becomes ₹1.2 lakh in a year.

Over five years, that adds up to ₹6 lakh – without counting any growth.

That amount can:

- Cover multiple medical emergencies

- Fund a child’s education gap

- Act as a strong emergency cushion

Chhoti kamai jab regular hoti hai, tab powerful ban jaati hai.

And that power looks different for different people.

For Salaried Professionals

For someone earning ₹30,000–₹50,000 per month, extra income does not mean greed.

It means relief.

Let’s look at a simple example.

- Monthly salary: ₹40,000

- Monthly fixed expenses (rent, EMIs, groceries, school fees): ₹32,000

- Monthly savings left: ₹8,000

Now add:

- Extra income: ₹12,000 per month

Suddenly:

- Savings jump to ₹20,000 per month

- Annual savings increase by ₹1.44 lakh

- One medical emergency does not wipe out years of planning

Even ₹10,000–₹15,000 of additional income can:

- Reduce credit card dependence

- Prevent dipping into long-term savings

- Create confidence that one job disruption won’t collapse everything

Chhota amount lagta hai, par impact bada hota hai – especially jab EMI SMS aate hain.

For Homemakers

For many homemakers, extra income is not calculated only in numbers.

But numbers still matter.

Consider this:

- Extra income from home: ₹8,000 per month

- Annual contribution: ₹96,000

That amount can:

- Cover annual household utilities

- Pay for a child’s coaching or activity classes

- Create a personal savings fund

More importantly, it changes the conversation at home.

When a homemaker contributes even ₹5,000–₹10,000 regularly, it brings:

- Financial independence

- Decision-making confidence

- A sense of equal participation

As many say quietly but proudly:

“Main bhi financially strong hoon.”

That feeling is not small – even if the income is.

For Students

For students, extra income is not about luxury spending.

It is about learning responsibility early.

Example:

- Part-time or flexible income: ₹6,000–₹10,000 per month

- Annual earning: ₹72,000–₹1.2 lakh

This can:

- Cover personal expenses

- Reduce dependence on parents

- Build discipline around money

Students who earn early often realize:

- Money has effort behind it

- Spending choices improve

- Confidence increases

An income source that also builds communication skills or real-world exposure is worth far more than quick cash.

Pehli kamai ka confidence alag hi hota hai.

For Retired or 45+ Individuals

At this stage, extra income is less about survival and more about stability with dignity.

Consider:

- Extra income: ₹10,000 per month

- Annual amount: ₹1.2 lakh

This can:

- Cover medical insurance premiums

- Handle regular health check-ups

- Reduce dependence on children

For many retired individuals, even a modest income means:

- Staying active

- Feeling relevant

- Maintaining self-respect

As many say honestly:

“Paise se zyada, kaam mein lagna zaroori hai.”

Income here comes with purpose – not pressure.

No matter the age or profession, one thing stays common.

Extra income:

- Reduces panic

- Increases confidence

- Creates options

It doesn’t have to be big.

It just has to be regular, reliable, and respectable.

Because in real life, financial strength is not built through sudden windfalls —

it is built quietly, month after month.

What Small Extra Income Really Adds Up To

Monthly Extra Income Annual Amount 5-Year Corpus ₹8,000 / month ₹96,000 / year ₹4.8 lakh ₹10,000 / month ₹1.2 lakh / year ₹6 lakh ₹15,000 / month ₹1.8 lakh / year ₹9 lakh Over time, small numbers create big cushions.

The Problem is Not Lack of Options

India today has no shortage of income ideas:

- Online gigs

- Part-time work

- Delivery-based jobs

- Freelancing

But most people hesitate because they ask practical questions:

- Is this stable?

- Is this legal?

- Will this work in my city?

- Can I talk about this confidently at home?

Not every opportunity answers these questions honestly.

That is why people are no longer just searching for side income.

They are searching for reliable extra income options in India.

In India, Trust is the Real Currency

In Indian society, decisions are rarely made because of advertisements alone.

People trust:

- Their local doctor

- Their neighborhood shopkeeper

- Someone who explains things patiently, without jargon

Human interaction matters.

Baat samajh mein aani chahiye.

That is why income opportunities built around guidance, awareness, and trust tend to last longer than quick, faceless gigs.

Awareness Gaps Create Sustainable Income

Millions of Indian families:

- Delay important financial decisions

- Feel confused by complex terms

- Say “baad mein dekhenge”

Not because they don’t care, but because nobody explains things clearly.

This gap between confusion and clarity creates real opportunities.

People who:

- Understand the problem

- Take time to explain

- Build trust instead of pressure

Often build steady, long-term extra income.

The income comes as a result of helping, not pushing.

And people remember who helped them when it mattered.

Extra Income Must Feel Respectable

This is critical in the Indian context.

An income source should be:

- Legal and transparent

- Easy to explain to family

- Acceptable in society

If someone feels uncomfortable talking about how they earn, that income rarely lasts.

Respect matters.

Izzat ke saath kamai honi chahiye.

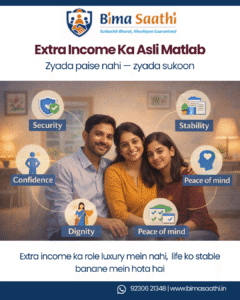

So, What Does Extra Income Really Mean Today?

In today’s India, extra income means:

- Security during emergencies

- Reduced dependence on a single salary

- Mental peace

- Confidence in facing uncertainty

- The ability to say, “haan, hum manage kar lenge”

It is not about shortcuts.

It is about being prepared.

People who understand this don’t chase quick money.

They build income paths that grow slowly – but steadily.

Because stability is not built overnight.

It is built one smart decision at a time.

FAQs

What does extra income mean in today’s India?

Extra income means financial safety, emergency readiness, and reduced stress from depending on a single income.

Why is extra income important for Indian families?

Rising healthcare, education, and living costs make one income insufficient for long-term security.

How much extra income is enough?

Even ₹10,000–₹15,000 per month can significantly improve stability and peace of mind.

Is extra income only for salaried professionals?

No. Homemakers, students, and retired individuals also seek extra income for independence and confidence.

What makes an extra income option sustainable?

Legal clarity, trust-based work, flexibility, and the ability to solve real problems.

Leave A Comment