| Key Summary

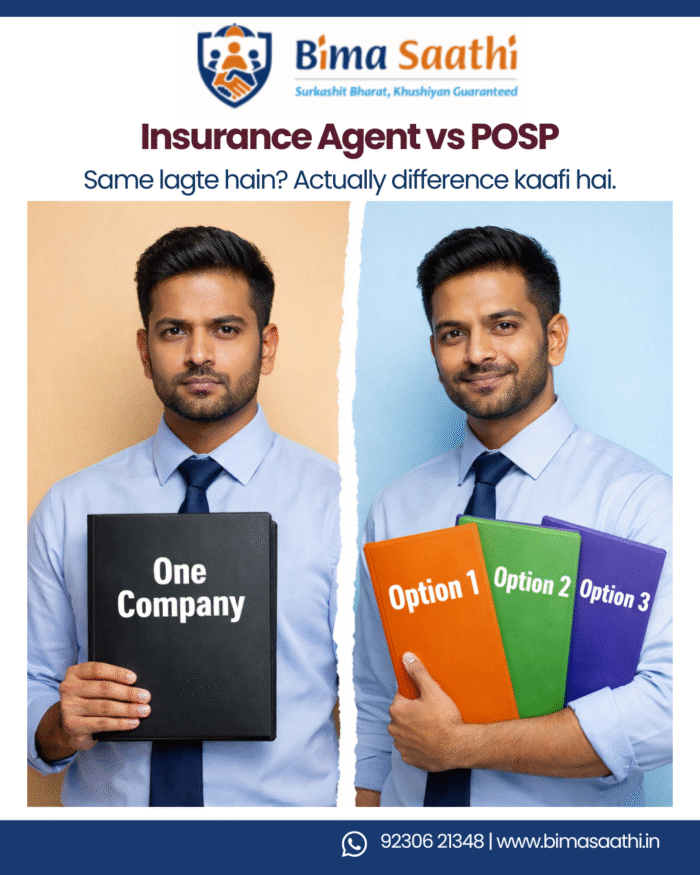

Confused about Insurance Agent vs POSP? You’re not alone. While both sell insurance, their structure, flexibility, product access, and earning models are quite different. This simple, practical guide breaks down the real difference between an Insurance Agent and a POSP in India – with examples, industry data, and career insights. No jargon. No hype. Bas clear clarity. |

If you’re exploring insurance – either to buy a policy or to start a career – one question keeps coming up:

Insurance Agent vs POSP – what’s the real difference?

At first glance, both look similar. Both sell insurance. Both earn commissions. Both talk about protection.

But structurally and practically, they operate very differently.

And trust me – this difference matters.

Let’s break it down in simple English, with practical clarity.

What is an Insurance Agent?

An Insurance Agent is a licensed individual who represents a single insurance company and sells that company’s products.

Simple definition:

An agent works for one insurer.

If someone is an LIC agent, they primarily sell LIC products.

If someone represents a private insurer, they sell that insurer’s plans.

That’s the structure.

Industry Context (India)

- India has over 28 crore life insurance policies in force (IRDAI data, 2023-24 approx.).

- Individual agents contribute nearly 45–50% of new business premium in traditional life insurance.

- There are 20+ life insurers and 30+ general insurers operating in India.

So yes, the agent model is still one of the largest distribution channels in the country.

Key Features of an Insurance Agent:

- Represents one insurance company

- Company-led training and product focus

- Fixed product portfolio

- Commission-based earnings

- Relationship-driven business model

Example:

Ramesh is an LIC agent.

When you approach him for a term plan, he will show you LIC’s available term options.

He can’t compare across companies. His role is brand-specific.

Clear. Structured. Focused.

What is a POSP?

POSP stands for Point of Sales Person.

A POSP is authorized to sell insurance products through a broker or intermediary, which means they may offer products from multiple insurance companies.

Simple definition:

A POSP works through a platform that gives access to multiple insurers.

So instead of one company’s product basket, they may present comparative options.

Why This Matters

India’s insurance penetration is around 4% of GDP – significantly lower than many developed markets.

Insurance density is roughly USD 90–100 per capita, depending on the year.

That tells us one thing:

There is still a large awareness and access gap – especially in Tier II and Tier III India.

The POSP model was introduced partly to improve accessibility and flexibility in distribution.

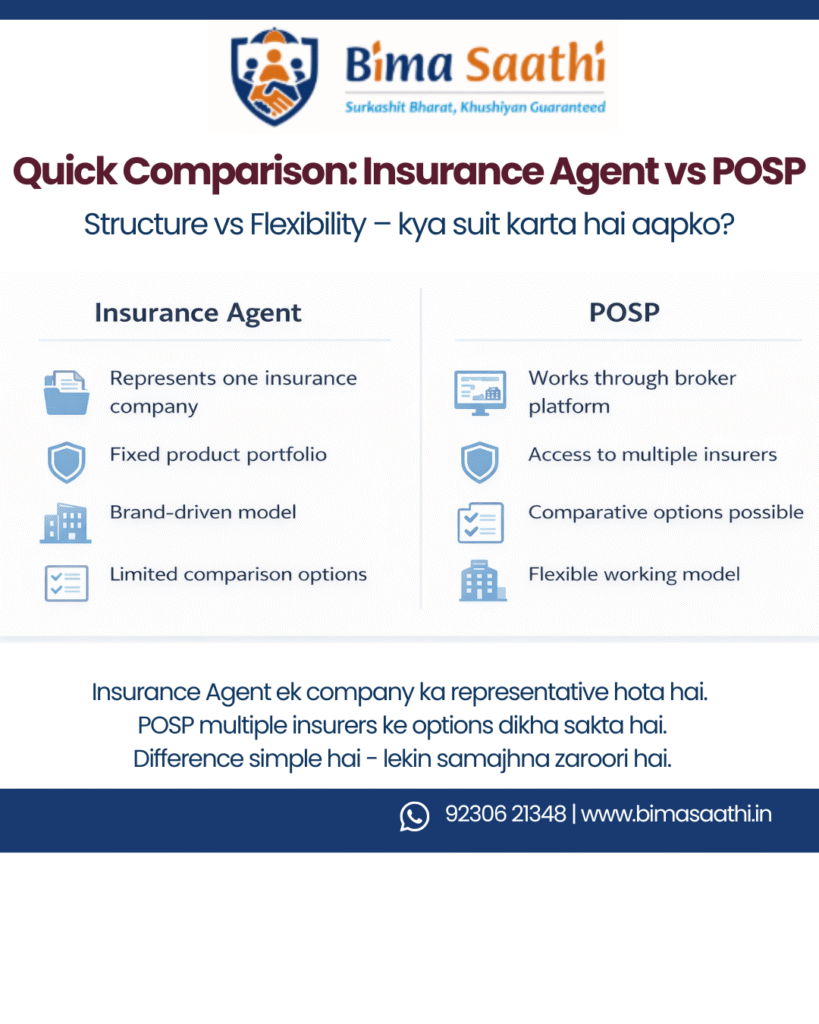

Insurance Agent vs POSP: Side-by-Side Comparison

Here’s a simple breakdown:

| Factor | Insurance Agent | POSP |

| Company Association | Single insurer | Multiple insurers (via broker) |

| Product Range | Limited to one company | Wider comparison options |

| Flexibility | Moderate | Higher |

| Customer Comparison | Limited | Possible |

| Earnings Model | Commission-based | Commission-based |

| Working Style | Brand-aligned | Advisory-style |

Short version:

Agent = One brand.

POSP = Platform access.

Simple hai. No confusion.

What Does This Mean for Customers?

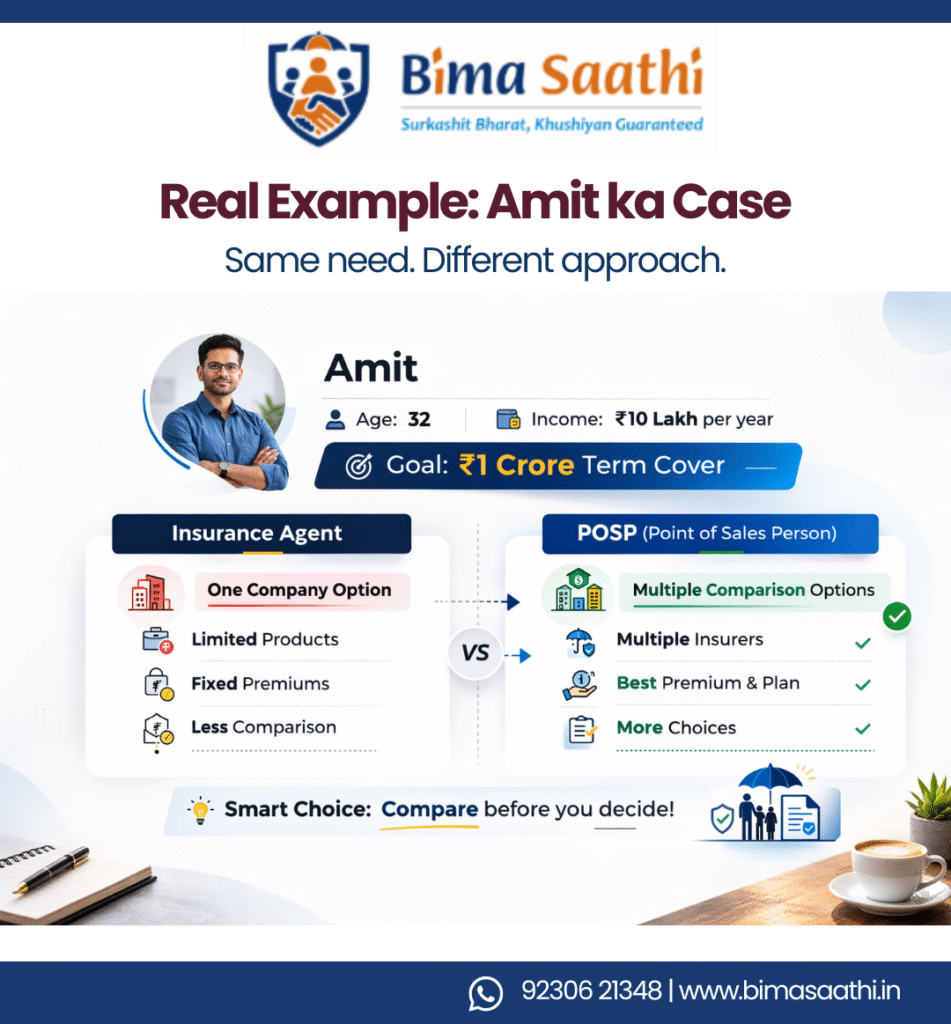

Let’s take a real scenario.

Case Study:

Amit, 32 years old, married, earning ₹10 lakh per year. He wants a ₹1 crore term insurance plan.

If He Meets an Insurance Agent:

The agent will show term plans from their company only.

Premium and features will depend on that insurer’s offerings.

If He Meets a POSP:

The POSP may compare:

- Premium differences

- Key features

- Riders available

- Claim settlement ratios (as per latest disclosed data)

Important: Claim settlement ratios and premiums change over time. Always check updated numbers.

But here’s the real point:

More options do not automatically mean better decisions.

Clarity matters more than comparison.

“Samajh ke decision lo.” That’s what truly counts.

Career Angle: Insurance Agent vs POSP

Now let’s talk about career opportunities.

India’s unemployment rate fluctuates around 7–8% (CMIE estimates). Underemployment is also common.

Insurance distribution has become an accessible income option, especially in non-metro cities.

But the working model differs.

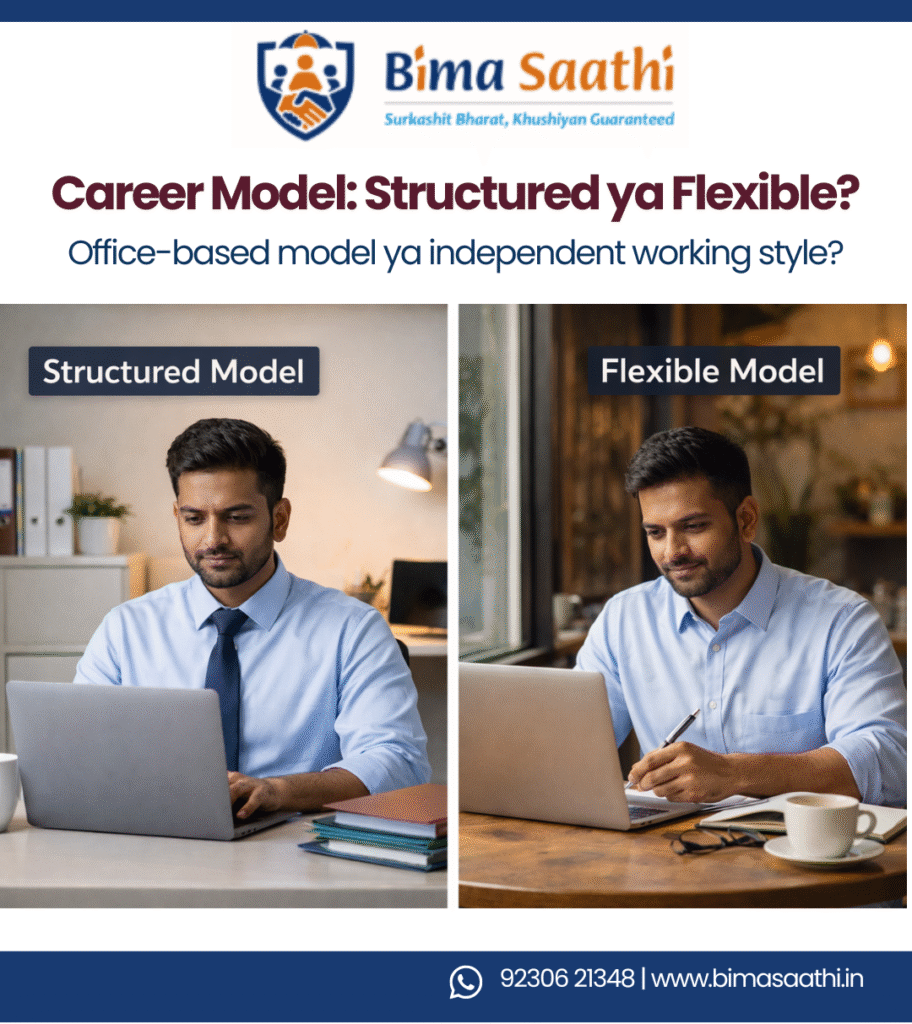

Insurance Agent Career Model

- Company-backed identity

- Structured training environment

- Long-term client relationships

- Potential renewal income over time

- Typically more brand-driven

This may suit individuals who prefer structure and long-term association with one brand.

POSP Career Model

- Flexible working hours

- Potential multi-product exposure

- Can be part-time or full-time

- Lower entry barrier in some cases

- Platform-driven model

This may suit:

- Homemakers looking for flexible income

- Working professionals exploring side income

- Small business owners leveraging local networks

But let’s be very clear:

Income depends on effort, consistency, and trust.

There is no guaranteed earning.

“Shortcuts kaam nahi karte.” Especially in insurance.

Earnings Reality: No Hype Zone

One of the biggest myths in the Insurance Agent vs POSP debate is about income.

Both models are commission-based.

In practice:

- Many new entrants struggle in the first 6–12 months.

- Consistent performers build referral networks.

- Renewal commissions play a major role in long-term income stability.

- Relationship management is critical.

Insurance is not a quick-money profession.

It is a trust-based profession.

And trust takes time.

“Trust pe business banta hai. Pressure pe nahi.”

Regulation & Certification

Both Insurance Agents and POSPs must:

- Complete required training hours

- Pass certification exams

- Follow regulatory norms

- Maintain ethical selling standards

Mis-selling can damage:

- Customer trust

- Personal reputation

- Long-term income potential

Ek galat sale – aur saalon ka trust khatam.

That’s why ethics matter in both models.

So Which One is Better?

This is the most common question in the Insurance Agent vs POSP discussion.

But here’s the honest answer:

It depends.

Consider:

- Do you prefer representing one brand?

- Do you want product comparison flexibility?

- Are you looking for part-time or full-time?

- Do you prefer structured training or platform independence?

There is no universal “better”.

There is only “better for you”.

Industry Growth Outlook

India’s insurance sector is projected to grow at approximately 7–9% CAGR across segments over the coming years (industry projections; actual growth varies).

Insurance penetration is still lower than global averages.

That means opportunity exists.

But sustainable growth will depend on:

- Education-first selling

- Ethical practices

- Long-term relationship building

- Responsible advice

Whether you choose to be an Insurance Agent or a POSP – the responsibility is the same:

Protect people’s futures responsibly.

Final Summary: Insurance Agent vs POSP

Let’s recap clearly:

- An Insurance Agent represents one insurer.

- A POSP works through a broker platform and may offer multiple insurers’ products.

- Both earn commissions.

- Both require certification.

- Both depend heavily on trust and consistency.

Insurance is not about pushing policies.

It’s about protecting families.

“Policy bechna aasaan hai. Vishwas kamaana mushkil hai.”

And the ones who understand this difference – win long term.

FAQs

Q1. What is the main difference between Insurance Agent vs POSP?

The main difference between Insurance Agent vs POSP is that an Insurance Agent represents one insurance company, while a POSP can offer products from multiple insurers through a broker platform.

Q2. Is POSP better than an Insurance Agent in India?

POSP is not automatically better than an Insurance Agent in India. The better option depends on flexibility, career goals, and whether product comparison is important to you.

Q3. Can a POSP sell policies from multiple insurance companies?

Yes, a POSP can sell policies from multiple insurance companies through a registered insurance broker or intermediary platform.

Q4. How much can an Insurance Agent or POSP earn in India?

Earnings for an Insurance Agent or POSP in India vary widely. Income depends on performance, customer trust, product mix, and consistency. There is no guaranteed fixed income.

Q5. Is it easier to become a POSP compared to an Insurance Agent?

In many cases, the POSP onboarding process may be simpler and faster. However, both roles require certification, compliance, and ethical selling practices.

If you’re still thinking about Insurance Agent vs POSP, remember:

Clarity first. Decision next.

“Samajh aa gaya, toh confidence aa gaya.”

Leave A Comment