| Key Summary

An insurance career in India is no longer just about selling policies – it’s about becoming a financial Saathi. This role focuses on explaining insurance in simple words, guiding families responsibly, and building trust over time. Formally known as POSP under IRDAI regulations, a Bima Saathi represents dignity, clarity, and long-term opportunity. Policy bechna ek kaam hai. Bharosa banana ek zimmedari hai. |

When we hear the word Saathi, what does it really mean?

A companion.

A partner in life.

Someone who walks beside you – not ahead of you, not behind you.

Bas saath chalne wala.

In India, we use the word Saathi with warmth. It carries trust. It carries responsibility. It carries emotion.

Now pause and think about money decisions.

When a family is choosing life insurance, health cover, or protection for their income – do they need a salesperson?

Or do they need a financial Saathi?

That simple shift in thinking is changing what an insurance career in India looks like today.

Why India Needs Financial Saathis More Than Ever

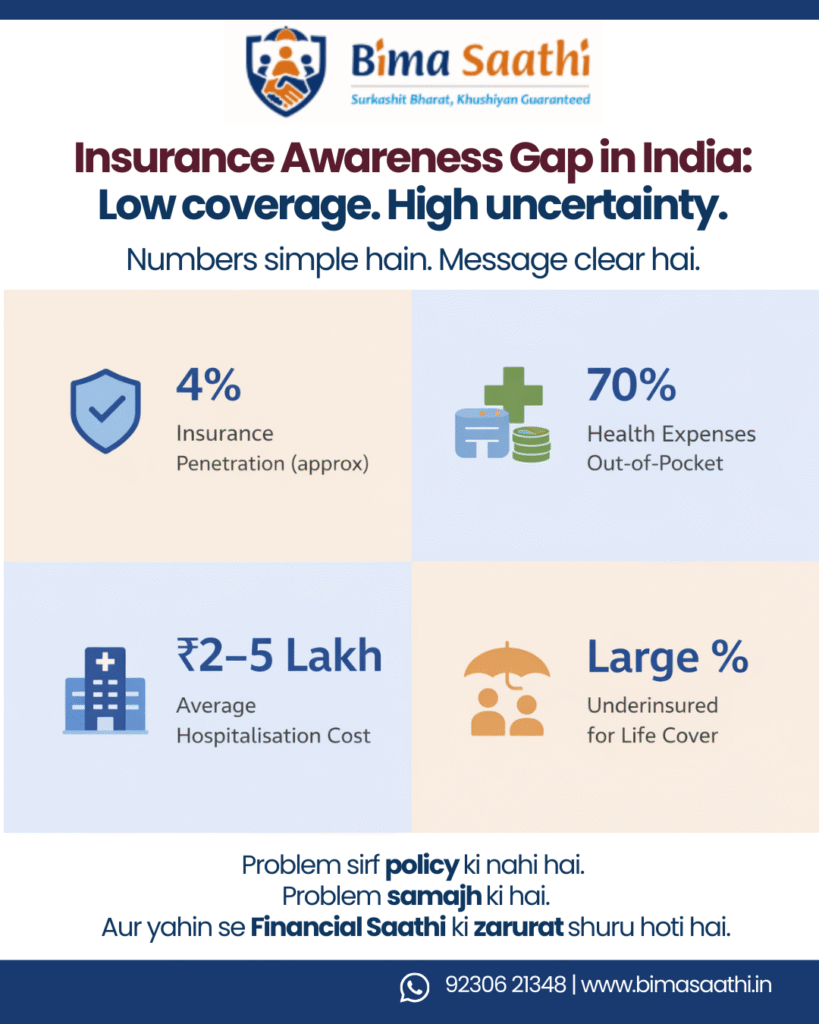

Let’s look at some real numbers – calmly, not dramatically.

- India’s insurance penetration is around 4% of GDP, significantly lower than many developed economies.

- Nearly 70% of healthcare expenses in India are still paid out-of-pocket.

- A single hospitalization in a private hospital can cost ₹2–5 lakh.

- In Tier II cities, ICU costs can range between ₹10,000–₹20,000 per day.

- According to industry estimates, a large percentage of working Indians are underinsured for life coverage.

These numbers are not meant to scare you.

They simply highlight one thing:

Insurance exists. But understanding insurance is still weak.

And when understanding is weak:

- Fear increases.

- Confusion spreads.

- Mistrust grows.

India doesn’t just need more insurance products.

India needs more people who can explain insurance clearly, calmly, and responsibly.

Yahin se shuru hota hai – ek naye insurance career ka safar.

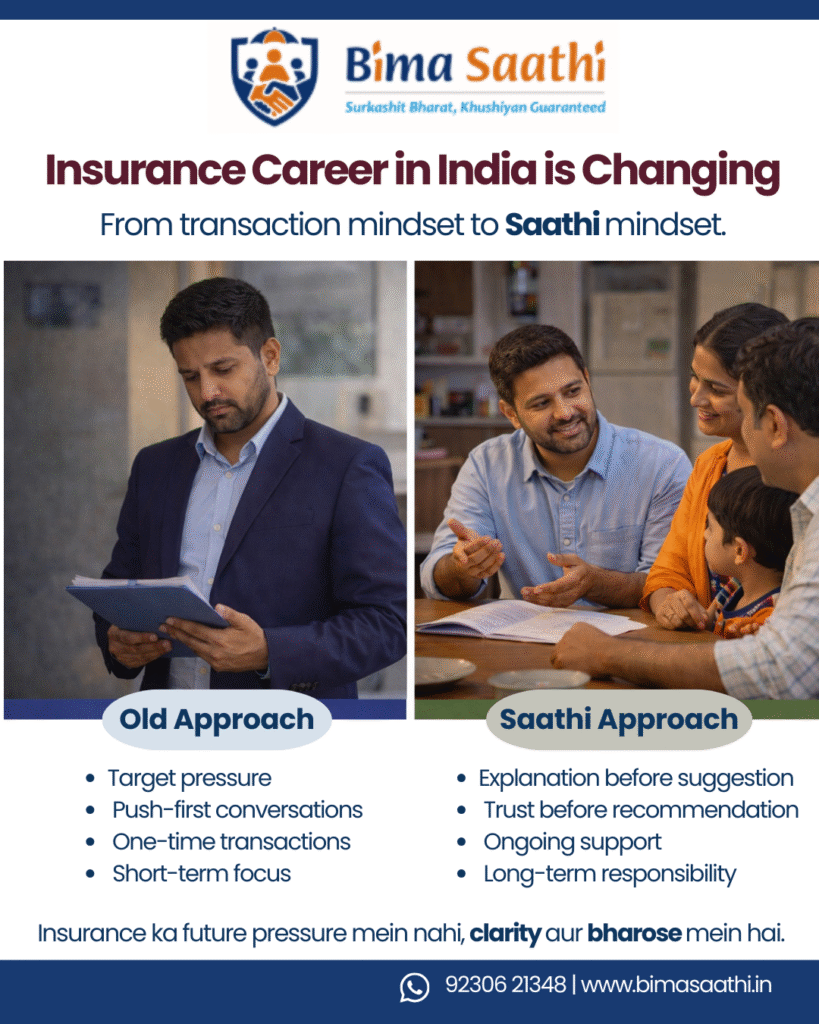

The Old Image of an Insurance Career and Why It’s Changing

Let’s be honest.

When someone says “career in insurance,” many people imagine:

- Door-to-door selling

- Target pressure

- Awkward conversations with relatives

- “Sir bas sign kar dijiye”

Not exactly inspiring.

But the insurance career in India is evolving.

Consumers today:

- Compare online.

- Ask more questions.

- Seek clarity.

- Distrust pressure.

The role is shifting from:

❌ Pushing products

to

✅ Explaining protection

From:

❌ Fast persuasion

to

✅ Patient education

From:

❌ Short-term sales

to

✅ Long-term relationships

Insurance is not about convincing people.

Insurance is about helping families prepare for uncertainty – in simple language.

Insurance as a Life Companion – Not Just a Policy

Think about it.

Life insurance protects income.

Health insurance protects savings.

Motor insurance protects liability.

Insurance, when explained properly, becomes a silent protector.

Insurance product nahi hai.

Insurance life ka humsafar hai – if understood correctly.

But a humsafar needs someone to introduce it properly.

That is where the Saathi comes in.

Who is a Bima Saathi?

Formally, under IRDAI regulations, individuals who are trained and certified to sell specific insurance products are known as POSP (Point of Sales Person).

But a designation does not capture the spirit of the role.

Here, we refer to such professionals as Bima Saathi – because their role is larger than selling.

A Bima Saathi:

- Simplifies insurance concepts.

- Answers questions without judgment.

- Recommends responsibly.

- Stays connected even after policy issuance.

- Values trust over transaction.

They are not policy pushers.

They are clarity creators.

And that clarity is what defines a modern insurance career in India.

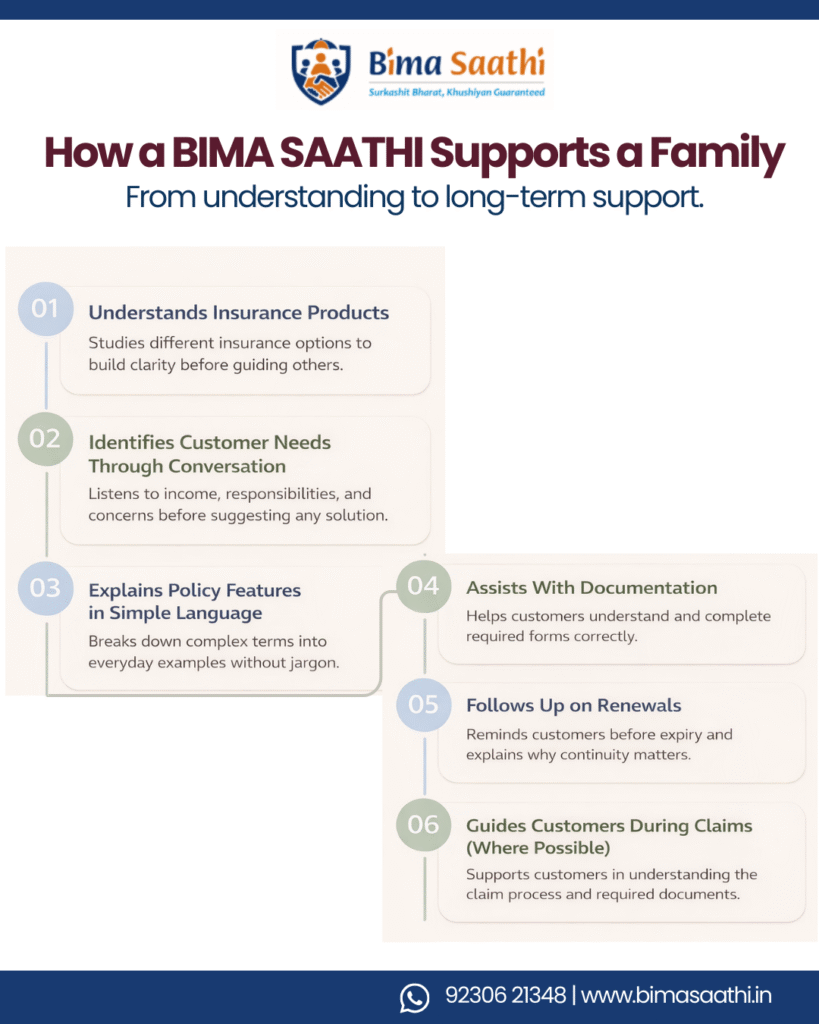

What Does This Insurance Career Actually Involve?

Let’s make it practical.

A Bima Saathi typically:

- Understands various insurance products.

- Identifies customer needs through conversation.

- Explains policy features in simple language.

- Assists with documentation.

- Follows up on renewals.

- Guides customers during claims, where possible.

For example:

A school teacher earning ₹40,000 per month wants to secure her family.

Instead of saying, “Take this ₹1 crore plan,”

a Saathi asks:

- What are your current expenses?

- Do you have loans?

- What is your savings capacity?

- Do you already have employer coverage?

The conversation becomes advisory, not transactional.

Sometimes the right answer is: “Let’s start small.”

Sometimes the right answer is: “Not this product.”

Pressure se policy bik sakti hai. Par pressure se trust kabhi nahi banta.

Why Small-Town India is Central to the Insurance Career Opportunity

In metros, people trust Google.

In smaller towns, people trust relationships.

Language comfort matters.

Cultural understanding matters.

Local presence matters.

A person explaining in familiar language – “Dekhiye, agar kal income ruk jaaye toh ghar kaise chalega?” – connects more deeply than a digital ad.

Insurance ka future sirf apps mein nahi hai.

Insurance ka future conversations mein hai.

That is why the insurance career in India is not just urban.

It is deeply local.

How Do Bima Saathis Earn?

Let’s address the practical question.

This is not a salaried employment role.

An insurance career in India, especially in this format, typically operates on a commission-based structure.

Income depends on:

- Policies facilitated

- Product categories

- Renewal persistence

- Customer trust

- Consistency over time

There is no guaranteed income.

There is no fixed monthly amount.

There is no shortcut.

Income depends on performance, effort, and relationship-building over time.

However, something important happens when trust builds:

- Customers refer others.

- Renewals become smoother.

- Conversations become easier.

Slow growth. Strong foundation.

Fast money fades.

Trust-based income sustains.

Who Can Consider an Insurance Career in India?

You do not need to be a finance expert.

You do not need an MBA.

You do not need prior sales experience.

But you do need:

- Patience.

- Communication skills.

- Willingness to learn.

- Ethical mindset.

- Long-term thinking.

Skill can be trained.

Attitude must be chosen.

“Main seekh sakta hoon” – that belief matters more than prior experience.

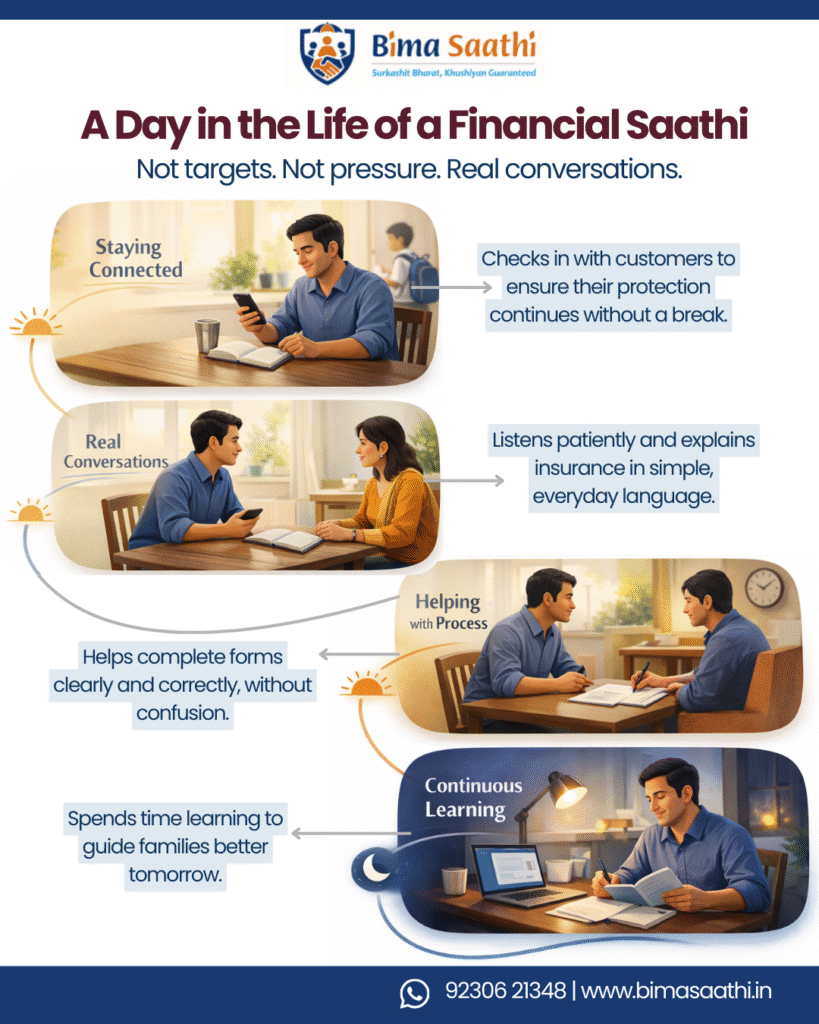

A Realistic Day in the Life

Morning:

- Checking renewal reminders.

- Calling an existing customer to clarify a doubt.

Afternoon:

- Meeting a family to explain term insurance vs savings plans.

Evening:

- Assisting someone with documentation.

- Updating records.

Night:

- Learning about new products.

- Reviewing compliance requirements.

It is structured.

It is disciplined.

It is relationship-driven.

Not dramatic. Not glamorous.

Meaningful.

Why Insurance Career Matters in the Bigger Picture

India’s financial literacy is improving, but still uneven.

According to surveys, a significant percentage of Indians are unaware of:

- Adequate life cover calculation.

- Policy exclusions.

- Claim procedures.

This knowledge gap creates vulnerability.

And every vulnerability creates two possibilities:

- Exploit

- Or educate.

A Saathi chooses to educate.

That is what makes this insurance career different.

Not louder. Clearer.

Not aggressive. Responsible.

The Shift in Mindset

Old thinking: “Insurance bechna hai.”

New thinking: “Insurance samjhaana hai.”

Old identity: Agent.

New identity: Saathi.

Insurance career in India is no longer about chasing targets blindly.

It is about building trust intentionally.

Final Thought

There are many people who sell insurance.

There are fewer who explain it clearly.

There are even fewer who stay connected when things get confusing.

That is the difference between a seller and a Saathi.

If you are exploring an insurance career in India, ask yourself:

- Do I want to push products?

- Or do I want to help families make better financial decisions?

Policy bechna skill ho sakta hai.

Bharosa banana character hota hai.

And character is what builds a lasting career.

FAQs

Q1. What is an insurance career in India?

An insurance career in India involves helping customers understand and choose insurance products while earning income through commissions based on policies facilitated.

Q2. What is a POSP in insurance?

A POSP (Point of Sales Person) is a trained and certified individual permitted to sell certain insurance products under IRDAI regulations.

Q3. How do insurance professionals earn in India?

Insurance professionals typically earn commission based on the policies they facilitate, and income depends on effort, consistency, and customer relationships.

Q4. Is an insurance career suitable for small towns in India?

Yes. Insurance careers can work well in small towns because local trust, relationships, and language comfort play a strong role in decision-making.

Q5. Do I need sales experience to start an insurance career?

No. Prior sales experience is not mandatory, but willingness to learn, communicate clearly, and act responsibly is essential.

Leave A Comment