We live in a world where almost everything has gone digital.

Groceries, banking, tickets, education – sab kuch online ho gaya hai.

UPI transactions cross 10+ billion transactions a month.

More than 750 million Indians are online today.

Insurance too is just a few clicks away.

Apps promise instant policies. Websites offer comparisons. So logically, insurance should be an easy decision.

But reality tells a different story.

Despite all the technology, insurance is still one of the most misunderstood and delayed financial decisions in India. And the reason is simple:

Insurance is not just a product.

Insurance is a promise.

And promises need trust. Bharosa.

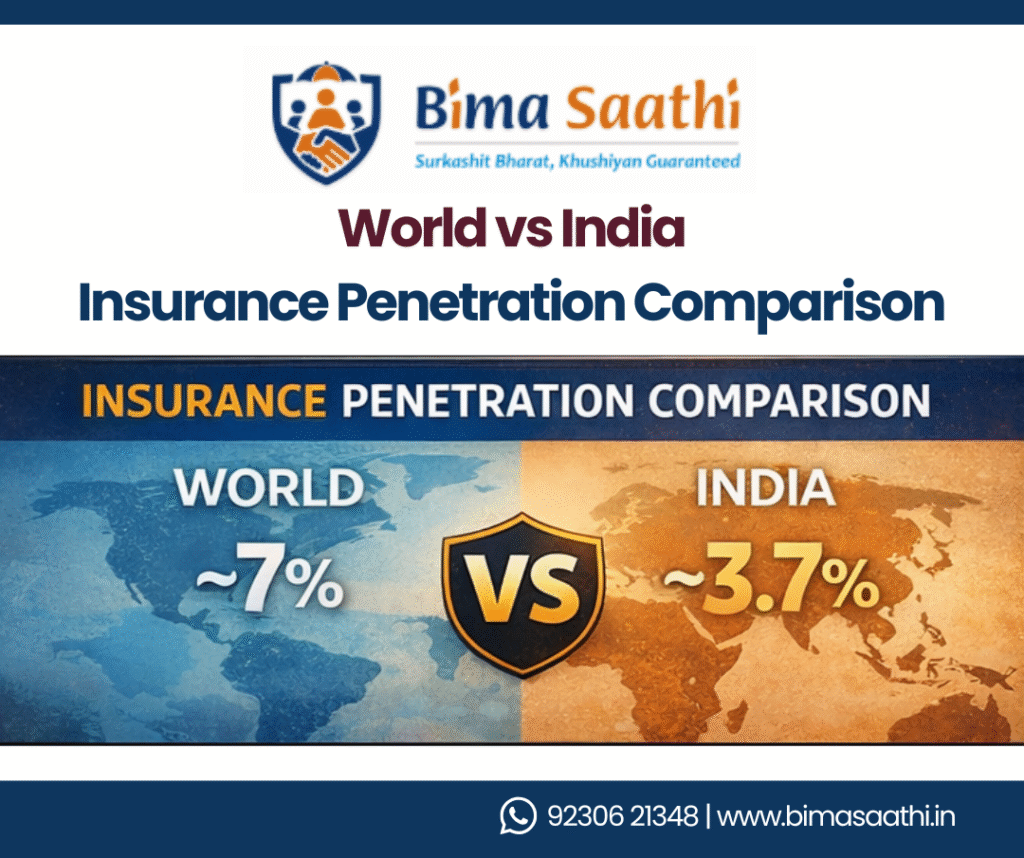

The Reality Check: Insurance Penetration is Still Low

Let’s start with a simple fact.

Despite decades of awareness:

- India’s insurance penetration is still under 4% of GDP

- In many Tier II and Tier III regions, it is even lower

This means:

- A large number of families remain underinsured

- Protection is delayed until a crisis hits

It’s not because people don’t care about their families.

It’s because they don’t fully understand insurance.

For example:

A ₹3–5 lakh hospital bill can wipe out years of savings for a middle-class family.

Yet many families still don’t have health insurance – not because they don’t want it, but because they delayed the decision.

Or as people often say: “Samajh aata toh le lete.”

Insurance is Not a Tech Decision. It’s a Human One.

Buying insurance is rarely a purely logical process.

People think about:

- “Agar mujhe kuch ho gaya toh family ka kya hoga?”

- “Claim ke time problem toh nahi aayegi?”

- “Main jo le raha hoon, sahi hai ya nahi?”

These are emotional questions.

And emotional questions don’t get answered by pop-ups or policy PDFs.

They get answered when:

- Someone listens patiently

- Someone explains in simple language

- Someone understands the local reality

That’s why, even today, human interaction plays a central role in insurance.

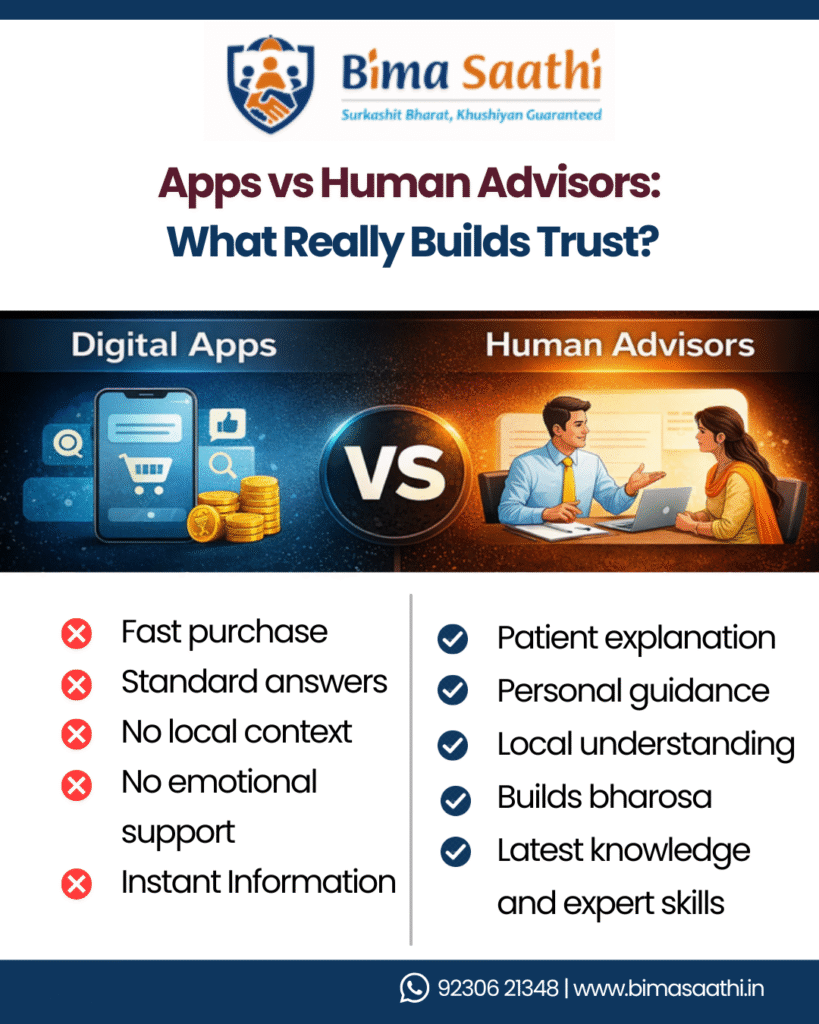

Why Apps and Websites Alone Don’t Build Trust

Insurance apps are useful. No doubt.

They are great for:

- Speed

- Convenience

- Paperless processes

But apps assume one big thing – that users already understand insurance.

In Tier II and Tier III cities, that assumption breaks.

People often struggle with:

- Complex terms and conditions

- Confusing coverage details

- Fear around claims and rejections

Most people don’t say, “I don’t want insurance.”

They say, “Samajh nahi aa raha.”

And when understanding is missing, trust disappears.

“Most people buy insurance only when someone they trust explains it.”

This is not a marketing line.

This is ground reality.

Think about how insurance is actually sold in India:

- Through a known person

- Through a local connection

- Through someone who speaks their language

A neighbour, a relative, a shop owner, a local insurance advisor – when koi apna explains insurance, the fear reduces.

“Agar aapko kuch ho gaya, family ka ye cover kaam aayega.” – That one sentence, explained calmly, does more than any comparison chart.

Because trust comes before transaction.

And trust is built through conversations, not screens.

The Real Gap is Not Insurance. It’s Understanding.

India doesn’t have a shortage of insurance products.

We have a shortage of clear explanation.

The biggest problem is not affordability.

It’s awareness.

Insurance often feels:

- Too technical

- Too formal

- Too distant

Especially in smaller towns, people need:

- Simple examples

- Real-life explanations

- Someone who can say, “Main aapko seedha samjhaata hoon.”

That’s the missing link.

“This gap between need and understanding is also a career opportunity.”

This is where the conversation changes.

Let’s connect the dots.

- People need insurance

- People don’t fully understand insurance

- Technology alone can’t solve this

So who fills this gap?

Real people.

Local people.

Trusted people.

This gap has created a new kind of opportunity – not sales-focused, but guidance-focused.

Why Human Interaction Matters Even More Today

Earlier, insurance agents were seen as salespeople.

Today, that role is evolving.

Modern insurance advisors are:

- Educators first

- Guides second

- Sellers last

Their real value lies in:

- Explaining options honestly

- Helping people make informed decisions

- Being available when questions arise

This role doesn’t require:

- Fancy English

- Corporate background

- Aggressive selling

It requires:

- The ability to listen

- The ability to explain

- The willingness to help

Samajhna aur samjhaana – bas itna hi.

Why Local Advisors Perform Better

In small towns:

- People trust local faces

- Word-of-mouth travels fast

- Reputation is everything

For example:

If one family has a smooth claim experience, that story reaches 10–15 other families easily.

That’s something no app notification can do.

This is why insurance demand is growing fastest outside metros – and why local advisors earn better in the long run.

Technology Supports. Humans Lead.

Let’s be clear – technology is important.

Digital tools help with:

- Faster onboarding

- Easy documentation

- Transparent tracking

But technology works best behind the scenes.

In insurance, the front-facing role still belongs to humans.

Because:

- Claims don’t feel stressful when a real person guides you

- Decisions feel safer when someone answers your doubts

- Trust grows when relationships exist

The future of insurance is not digital or human.

It’s digital + human.

Why This Model Works Best in Small Towns

In smaller cities and towns:

- Word travels fast

- Reputation matters

- Relationships are everything

People don’t trust ads easily.

They trust people they know.

That’s why local advisors do better than distant call centers.

Someone who:

- Understands the local mindset

- Knows the financial realities

- Speaks the same language

…naturally becomes the go-to person.

Insurance demand in India is growing fastest outside metros.

And that’s where human interaction has the highest value.

Insurance as a Career with Purpose

For many people, work is just income.

But insurance advisory can be income + impact.

By helping someone choose the right cover, you:

- Protect a family’s future

- Reduce financial shocks

- Create long-term security

And at the same time:

- You build a steady source of income

- You work at your own pace

- You earn respect in your community

This is not overnight success.

But it is sustainable growth.

The Role of a “Saathi,” Not a Salesperson

The word Saathi means companion.

Someone who walks with you.

That’s exactly what modern insurance needs.

Not pressure.

Not pushy selling.

But guidance.

Someone who says:

- “Main hoon na, aapko samjhaane ke liye.”

- “Decision aapka hoga, main sirf madad karunga.”

- “Main aapko options samjha deta hoon, decision aap lijiye.”

That’s how trust are long-term relationships are built.

And that’s how insurance truly works.

Final Thought: Bharosa Will Always Win

No matter how advanced technology becomes,

insurance will always remain human at its core.

Because when life is uncertain, people don’t look for apps.

They look for assurance.

They look for:

- Bharosa

- Samjhaane wala insaan

- Someone they can rely on

That’s why human interaction still works in insurance.

And that’s why it always will.

And if you are someone who can explain, guide, and genuinely help – then this growing gap between need and understanding might just be your opportunity to build something meaningful.

FAQs

Q1. Why do people still prefer insurance advisors over apps?

While apps offer convenience, many people find insurance terms confusing. A trusted insurance advisor explains coverage, exclusions, and claims in simple language, helping people make confident decisions – especially in Tier II and Tier III cities.

Q2. Why is insurance awareness still low in India?

Insurance awareness is low not because of lack of products, but because of lack of understanding. Many people say they didn’t buy insurance earlier because no one explained it properly in simple, relatable terms.

Q3. Can technology replace human interaction in insurance?

No. Technology improves speed and efficiency, but it cannot replace trust. Insurance works best when technology supports the process and humans lead the relationship, especially during decision-making and claims.

Q4. Why do local insurance advisors perform better in small towns?

In small towns, people trust familiar faces more than brands or apps. Local advisors understand regional needs, speak the same language, and build trust through word-of-mouth, making them more effective over time.

Q5. How much can a part-time insurance advisor earn?

Earnings vary by effort, location, and network. Many part-time advisors start with ₹8,000–₹15,000 per month and grow steadily as trust and referrals increase. It is not instant income, but it can become stable over time.

Leave A Comment