| Key Summary

A POSP career in insurance is emerging as one of India’s most accessible and flexible income opportunities, especially in Tier II and Tier III cities. With low entry barriers, regulated certification, and growing insurance demand (India’s insurance penetration is ~4% vs global average ~7%), the opportunity is real. But it is not a shortcut to quick money. This guide honestly explores whether this career truly fits you. |

Let’s start with an honest moment.

When you hear insurance agent, what comes to mind?

- Pushy salesman?

- Commission-based uncertainty?

- Ya phir koi jo mushkil waqt mein saath khada hota hai?

The truth? The industry has seen all types.

But today, the POSP career in insurance is evolving – more structured, more regulated, more professional.

This blog is not here to “convince” you.

It is here to help you decide clearly.

Because career decisions hype se nahi, honesty se liye jaate hain.

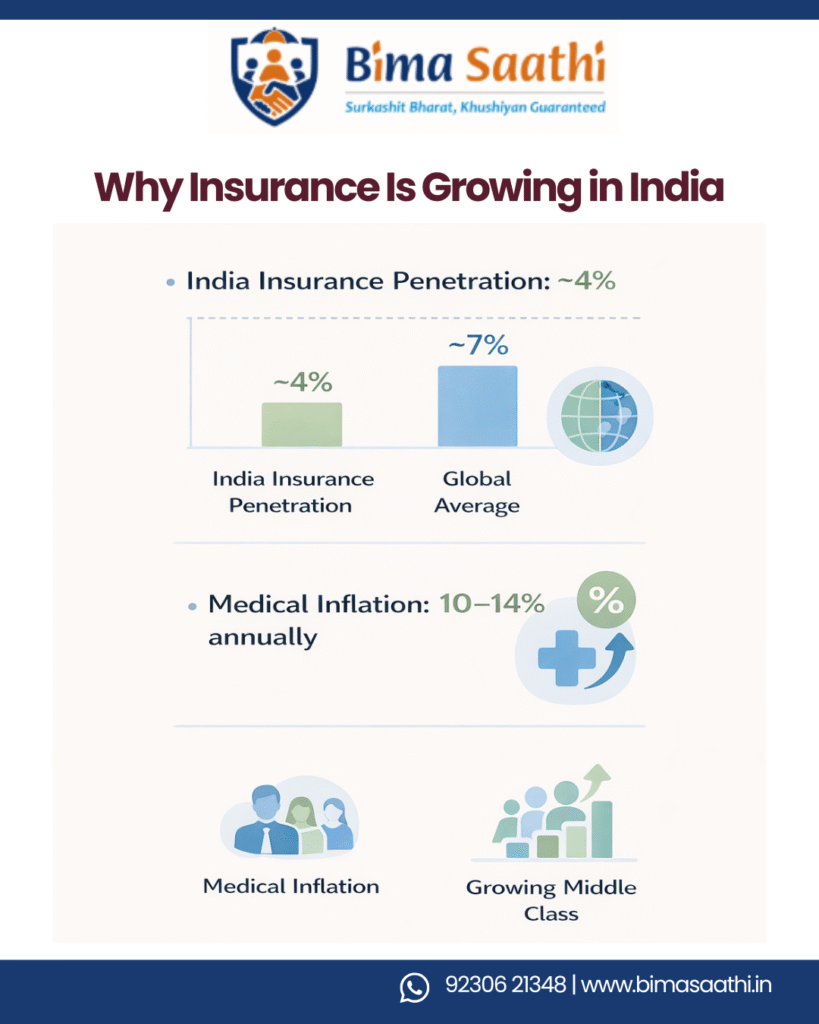

Why Insurance is Growing in India (And Why That Matters)

Before choosing any career, ask: Is the industry growing?

Let’s look at facts:

- India’s insurance penetration is around 4% of GDP.

- Global average is close to 7%.

- Over 65% of Indians lack adequate life insurance coverage.

- Medical inflation in India is rising at 10–14% annually.

- India’s middle class is projected to cross 580 million by 2030.

Translation?

Massive protection gap.

Massive awareness gap.

Massive opportunity gap.

Insurance is not a shrinking sector.

It is expanding – especially in smaller cities and towns.

But opportunity alone doesn’t mean it’s right for you.

What Exactly is a POSP Career in Insurance?

A POSP (Point of Sales Person) is a certified individual authorized to sell specific insurance products after completing mandatory training and passing an exam.

This career is:

✔ Legally recognized

✔ Regulated

✔ Flexible

✔ Performance-linked

It is NOT:

❌ A government job

❌ A fixed monthly salary role

❌ A guaranteed-income scheme

Important clarity.

You are not applying for a seat.

You are building your own network.

Is a POSP Career in Insurance Safe?

Let’s address the biggest silent doubt:

“Yeh legal hai na?”

Fair question. Bilkul valid.

Regulated by IRDAI

Insurance distribution in India is governed by IRDAI (Insurance Regulatory and Development Authority of India) – the statutory regulator.

To become a POSP:

- You must complete authorized training.

- You must pass certification.

- You must be registered under an approved intermediary.

- Your sales are recorded digitally.

This is a regulated financial activity – not informal selling.

Recognized Profession

India has:

- 20+ life insurers

- 30+ general insurers

- Millions of agents and POSPs

Insurance contributes significantly to the national economy.

This is part of India’s formal financial ecosystem.

Income is Structured and Documented

In a legitimate POSP career in insurance:

- Commissions are predefined.

- Pay-outs are system-generated.

- Income is documented.

- Tax compliance applies.

If someone promises:

- “Guaranteed ₹1 lakh per month”

- “No exam needed”

- “Instant riches”

- “Cash income, no paperwork”

🚩 Red flag.

Insurance is legal.

Exaggeration is not.

Safety Checklist Before Joining

Ask these:

✔ Is certification mandatory?

✔ Are commissions explained transparently?

✔ Is ethical selling encouraged?

✔ Is documentation clear?

If clarity is missing – pause.

Career decisions jaldi mein nahi hote.

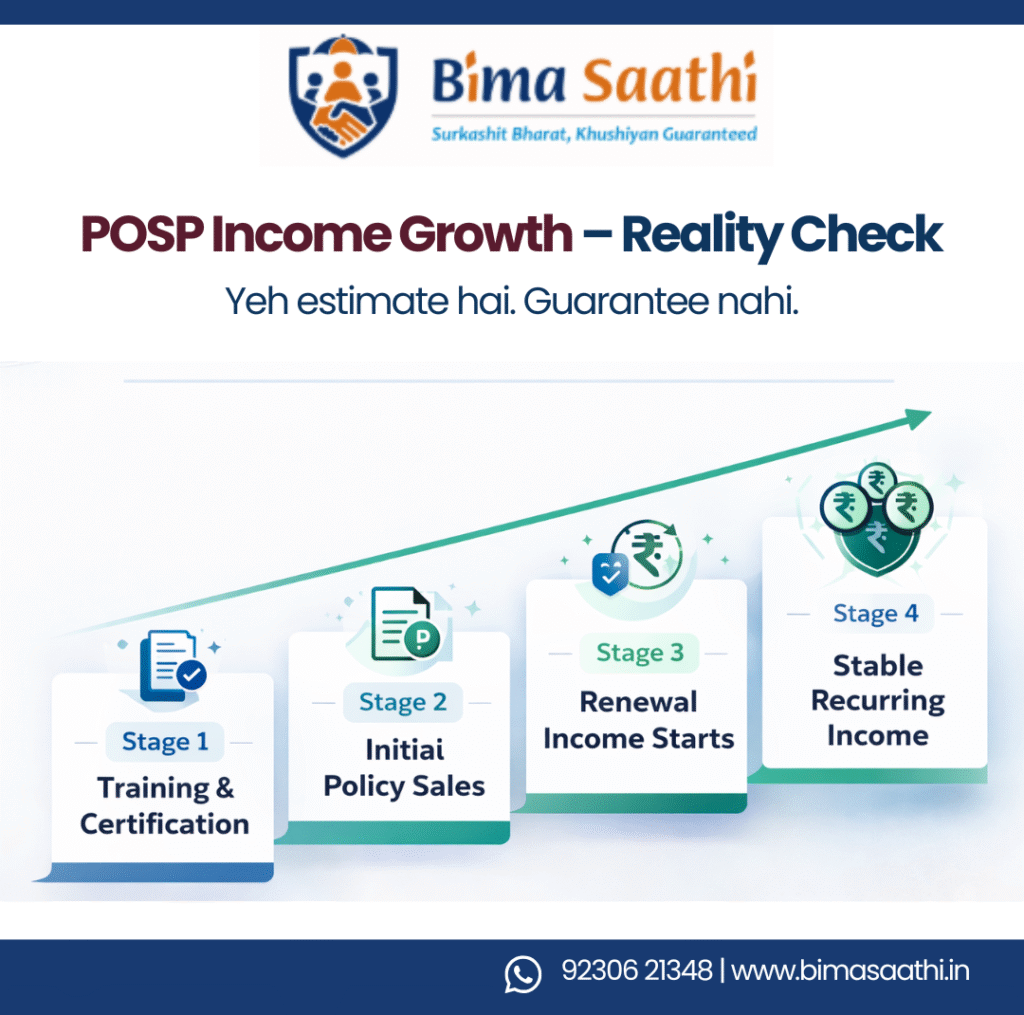

Income Reality: No Hype, Just Truth

Let’s talk money – honestly.

A POSP career in insurance is performance-based.

Your income depends on:

- Number of policies sold

- Product mix

- Persistency (renewals)

- Customer retention

- Your consistency

Illustrative Example

If you sell:

- 10 health policies per month

- Average premium ₹15,000

- Commission ~15%

That could mean roughly ₹22,000 monthly initially.

As you grow:

- 20–25 policies monthly

- Mix of health, motor, and term

- Strong renewals

Income may scale beyond ₹50,000–₹1,00,000+ monthly over time.

But remember:

First 3–6 months = foundation building.

Insurance income is like farming.

Aaj beej, kal fasal.

Renewals create stability.

Stability creates confidence.

These are probability-based illustrations, not performance guarantees.

Also Read: How Much Can a POSP Earn?

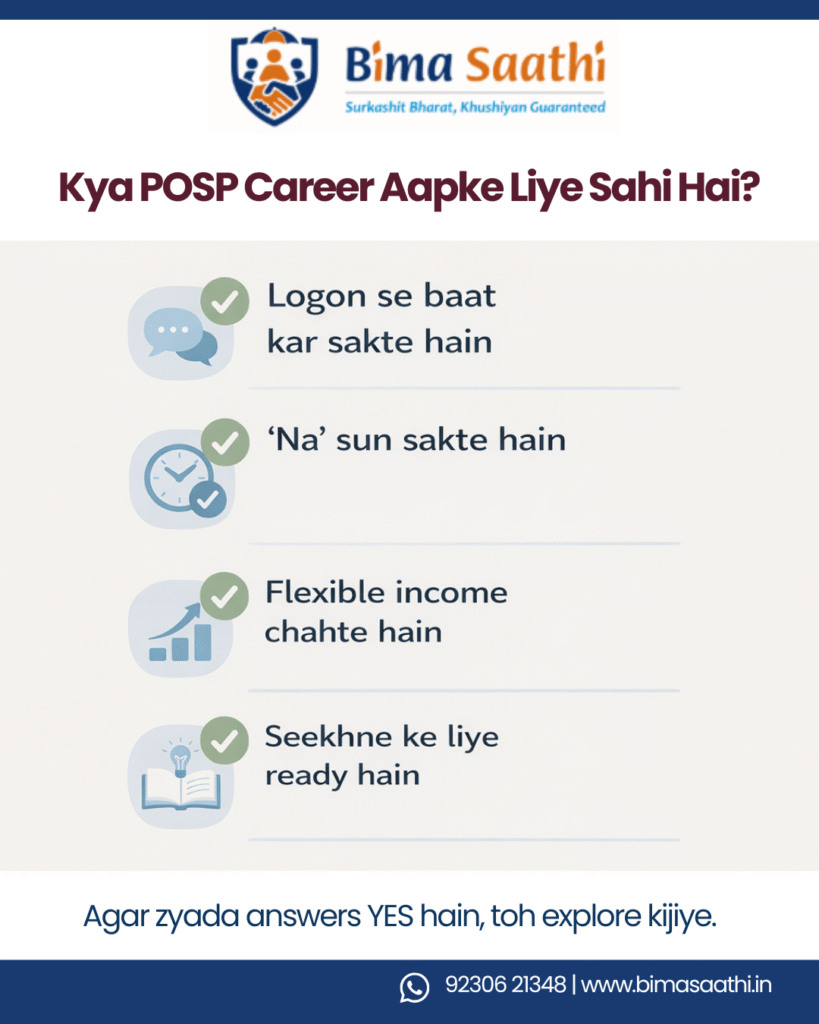

Who is This Career Actually Suitable For?

Be brutally honest with yourself.

A POSP career in insurance suits you if:

✔ You like talking to people

Not just talking – listening.

✔ You value relationships

Insurance is trust-based.

✔ You can handle “No”

Rejection is part of the process.

You will hear:

- “Soch ke batate hain.”

- “Already policy hai.”

- “Budget tight hai.”

Thoda patience chahiye.

✔ You want income flexibility

No cap. But also no fixed minimum.

✔ You are self-driven

No boss checking attendance daily.

Freedom + responsibility.

Also Read: Skills Required for a Successful Insurance Career in India

Advantages of a POSP Career in Insurance

- Low Entry Barrier

Minimal educational requirement + certification.

Compared to starting a business, risk is low.

- Flexible Work Model

Full-time, part-time, parallel income – your choice.

- Unlimited Growth Potential

Salary jobs have slabs.

Insurance has scalability.

- Social Impact

When a claim gets settled during a crisis, you are not “agent.”

You are the person who ensured protection.

Aur woh feeling? Powerful.

Challenges No One Tells You

Let’s balance the picture.

- Income Fluctuations Initially

Early months can feel uncertain.

- Emotional Resilience Required

Rejection tests confidence.

- Reputation Risk

One wrong promise can damage long-term growth.

- Continuous Learning

Products evolve. Regulations update.

Insurance simple lagta hai.

Deep samajhna padta hai.

Why Tier II & Tier III India Has Massive Potential

Smaller towns have:

- Lower insurance penetration

- High relationship trust

- Strong word-of-mouth networks

- Growing financial awareness

Insurance growth in non-metro markets is accelerating.

Digital onboarding has simplified processes.

If you belong to such towns, your network is your strength.

Yeh aapka advantage hai.

Also Read: Is an Insurance Career in Tier 2 and Tier 3 Cities a Smart Opportunity?

Ethics: The Real Differentiator

Here’s a line worth remembering:

“Shortcuts sell policies. Integrity builds careers.”

Fear-based selling may create quick sales.

But ethical selling creates:

- Renewals

- Referrals

- Long-term income

Customers don’t stay for pressure.

They stay for protection.

Is It Stable Long-Term?

If stable means fixed salary – no.

If stable means:

✔ Growing industry

✔ Regulatory protection

✔ Renewable income

✔ Increasing awareness

Then yes, structurally stable.

India’s insurance market is projected to become one of the top global markets by 2032.

Demand is rising.

But your personal success depends on:

- Effort

- Consistency

- Ethics

- Learning

Industry opportunity is real.

Individual outcome is effort-driven.

Common Myths About Insurance Agency

❌ “Only desperate people do this.”

✔ Many professionals choose it for entrepreneurship flexibility.

❌ “Income is unreliable.”

✔ Early stage yes. Renewals stabilize long-term income.

❌ “People don’t trust agents.”

✔ People don’t trust exaggeration. They trust honesty.

❌ “It’s outdated.”

✔ Digital platforms have modernized the entire system.

Also Read: Top Myths About Insurance Agent Career

So… Is Insurance Agency the Right Career for You?

Choose a POSP career in insurance if:

- You want flexible income.

- You value trust-building.

- You can handle slow beginnings.

- You believe in ethical work.

- You want long-term growth.

Avoid it if:

- You want guaranteed salary.

- You dislike interacting with people.

- You prefer fixed routine structure.

- Rejection deeply demotivates you.

Final Thought

Insurance is not glamorous.

It is meaningful.

You may not trend on Instagram.

But you might secure someone’s child’s education.

You might protect a family from medical debt.

You might prevent financial collapse.

Aur kabhi kabhi –

“Thank you bhaiya, aapne sahi policy suggest ki thi”

is bigger than any award.

Insurance is not about selling fear.

It is about building confidence.

If that resonates with you,

a POSP career in insurance deserves serious thought.

FAQs

Q1️. What is a POSP career in insurance?

A POSP career in insurance allows individuals to become certified agents who sell approved insurance products after completing mandatory training and passing an exam.

Q2️. Is a POSP career in insurance legal in India?

Yes, a POSP career in insurance is legal and regulated by IRDAI, and requires official training and certification.

Q3️. How much can you earn in a POSP career in insurance?

Income depends on policies sold, product mix, and renewals. There is no fixed salary, but consistent effort can build recurring income over time.

Q4️. Is insurance agency a safe career option?

Insurance agency is structurally safe as it operates in a regulated industry, but individual income stability depends on effort and ethical practices.

Q5️. Can a POSP career in insurance be done part-time?

Yes, a POSP career in insurance can be pursued part-time, making it suitable for students, homemakers, and working professionals.

Leave A Comment