Why delaying important financial decisions can cost more than money

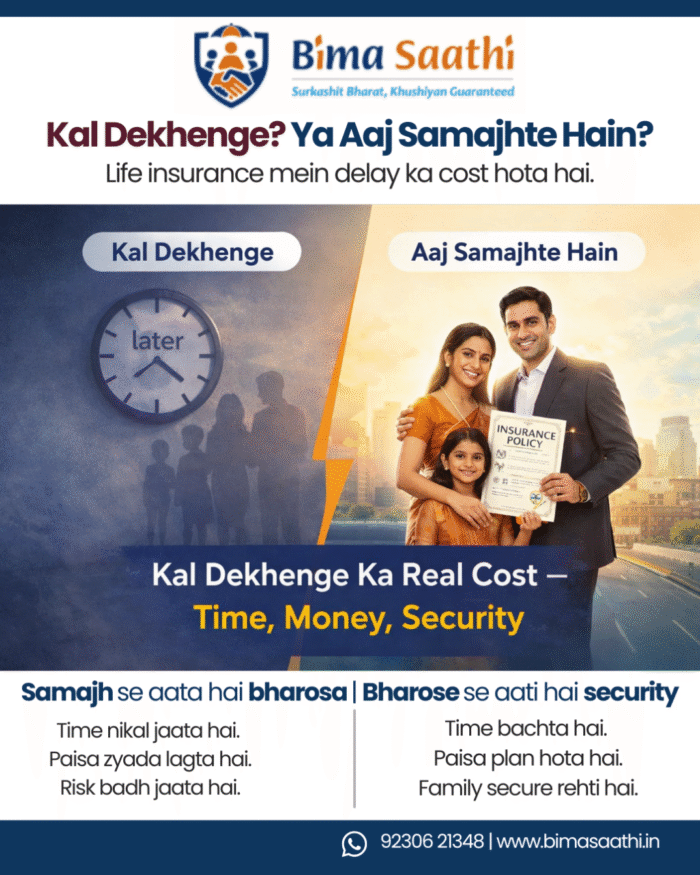

“Kal dekhenge.”

We say it casually. Comfortably. Almost proudly.

Kal insurance dekhenge.

Kal extra income ke baare mein sochenge.

Kal planning shuru karenge.

But here’s the uncomfortable truth: “Kal dekhenge” is not harmless. It is expensive.

Not expensive like a phone or a vacation.

Expensive in ways we don’t notice immediately – lost money, lost time, lost opportunities, and sometimes… lost security.

This is for anyone who earns today, supports a family, and believes they’ll “figure it out later.”

The Indian Reality: We Don’t Avoid Problems, We Postpone Them

In most Indian households, life runs on priorities:

- School fees

- Monthly EMI

- Daily expenses

- Family responsibilities

So when something feels “important but not urgent,” we push it forward.

Insurance? Kal dekhenge.

Savings? Abhi manage ho raha hai.

Extra income? Job toh chal rahi hai.

This isn’t laziness. It’s habitual postponement. And habits compound – just like money does.

The Hidden Cost of “Kal Dekhenge”

Financial Cost: Decisions Delayed Are Money Lost

Every delayed decision has a silent price.

- Insurance taken late = higher premiums

- Savings started late = lower compounding

- Extra income explored late = fewer earning years

Two people earning the same salary can end up with very different futures – not because one earned more, but because one decided earlier.

Time is the only asset you can’t recover.

Emotional Cost: Constant Anxiety in the Background

When we delay important decisions, the mind doesn’t forget them.

That quiet thought stays in the background: “Kuch toh karna chahiye…”

It shows up during medical emergencies.

During job uncertainty.

During unexpected expenses.

Postponement doesn’t remove stress – it stores it for later, often when we are least prepared.

Opportunity Cost: What You Didn’t Start Matters More Than What You Failed

Most people regret not failures – they regret not starting at all.

- Didn’t explore that side income

- Didn’t understand insurance when it was simple

Opportunities don’t disappear loudly.

They fade quietly while we’re saying, “Kal.”

Why Life Insurance Suffers the Most from “Kal Dekhenge”

Life insurance doesn’t remind you daily that you need it.

There are no alerts. No warnings. No deadlines.

Everything feels fine – aaj toh sab theek hai.

That’s why people delay it:

- Because it doesn’t feel urgent

- Because it’s emotionally uncomfortable

But life doesn’t work on convenience. Accidents, illness, and uncertainty don’t wait for “kal”.

Why Life Insurance is Actually Required

Life insurance is often misunderstood as a product. In reality, it is a financial responsibility.

Income Protection for the Family

Ask one honest question: If your income stops tomorrow, how long will your family manage?

Rent or EMI.

School fees.

Monthly expenses.

Medical needs of parents.

Life insurance exists for one simple reason: Your family’s life should not collapse if your income is disrupted.

Think of it this way:

If a family depends on ₹30,000 per month, that’s ₹3.6 lakh a year.

Over 10 years, that’s ₹36 lakh needed just to maintain basic living.Life insurance exists to bridge this gap when income suddenly stops.

Preventing Financial Panic During Emotional Crisis

Loss is already heavy.

Money problems make it unbearable.

In many Indian families, the real struggle starts after the emotional shock:

- Savings disappear

- Loans begin

- Dependence increases

Life insurance doesn’t reduce grief. But it prevents financial chaos when the family is most vulnerable.

In many families, emergency expenses are managed through savings or loans.

But if ₹5–10 lakh of savings is exhausted within the first few years, rebuilding it without regular income becomes nearly impossible.

The Cost of Delay is Very Real

This is where “kal dekhenge” becomes expensive.

- Higher age = higher premiums

- Health issues = fewer options

- Late decisions = lower coverage

Simply put – the same protection costs more tomorrow than it does today.

Time is the biggest factor people underestimate.

So Why Do People Still Delay Life Insurance?

Most Indians delay getting Life Insurance because understanding is missing. Most people are not against life insurance. They are against:

- Complicated explanations

- Sales pressure

- Fear of making the wrong choice

When things feel confusing, the mind chooses delay. Abhi rehne dete hain. Kal dekhenge.

Here’s a simple example:

A 30-year-old buying life insurance may pay around ₹800 – ₹1,000 per month for basic coverage.

The same person at 40 could pay nearly double for similar protection or get lower coverage for the same amount.Same person. Same need. Only difference? Time.

Why We All Say “Kal Dekhenge” and Why It Feels Safe

Let’s be honest, “Kal dekhenge” feels safe because:

- It avoids discomfort

- It avoids responsibility

Immediate life continues unchanged.

But comfort today often means pressure tomorrow.

Awareness Changes Everything

The goal isn’t to do everything today.

The goal is to stop postponing understanding.

When people finally sit down and understand:

- How insurance protects families

- How small extra incomes reduce pressure

- How local guidance creates trust

They realize something important: “Yeh complicated nahi tha. Bas kisi ne samjhaya nahi.”

The Real Problem: Awareness Gap, Not Intent Gap

India doesn’t suffer from lack of products.

India suffers from lack of simple explanation. Especially in Tier II & III towns.

People don’t need pressure.

They need clarity.

They need someone local.

Someone patient.

Someone who understands their reality.

This gap – between confusion and clarity – is where real change happens.

From Awareness to Opportunity: A Natural Progression

Here’s a truth most people discover late: People who understand important financial decisions naturally become the people others turn to.

And when guidance becomes valuable, opportunities follow.

Not overnight.

Not magically.

But steadily. Respectfully.

This is why roles like Insurance Advisors / POSPs are growing quietly across India – not because people want to sell, but because people want someone they can trust.

Ask Yourself This

How many times have you said “kal dekhenge” about your future?

What would change if you simply decided to understand today?

What if your awareness could help not just you, but others too?

You don’t need a big leap. You just need to stop postponing the first step.

Final Thought: Kal Comes at a Cost

“Kal dekhenge” feels free.

But life insurance doesn’t reward comfort – it rewards preparedness.

Interest in missed income.

Interest in delayed security.

The most powerful shift is simple: From “kal dekhenge” to “aaj samajhte hain”.

Everything else follows.

FAQs

Q1. Why is procrastination costly in financial decisions?

Procrastination is costly because most financial decisions depend on time, and delaying them increases costs while reducing long-term benefits.

Q2. Why do people delay important financial decisions in India?

People delay important financial decisions in India because of limited awareness, complex information, and a lack of trusted guidance.

Q3. How does financial awareness create income opportunities?

Financial awareness creates income opportunities by building trust, which allows people to guide others and earn through long-term relationships.

Leave A Comment