| Key Summary

Insurance agent career in India is often misunderstood. Many people believe it’s unstable, low-paying, or “sirf bechne ka kaam.” But the truth is very different. With rising insurance awareness, flexible earning potential, and structured training, it has become a serious professional opportunity — especially in Tier II and Tier III India. Let’s break the biggest myths and uncover the reality. |

“Insurance agent? Achha… aur koi job nahi mila kya?”

Let’s be honest.

When someone says they want to build an insurance agent career in India, reactions are often awkward.

Some smile politely. Some judge silently.

And some say it directly – “Isme future hai kya?”

But here’s the reality:

India is one of the most underinsured large economies in the world. According to IRDAI reports:

- India’s insurance penetration (premium as % of GDP) was around 4% in 2022, compared to the global average of ~7%.

- Life insurance penetration stands around 3%, and general insurance even lower.

- Over 65% of India’s population lives in Tier II and Tier III cities, where awareness is growing but advisory access is still limited.

In simple words?

Demand badh raha hai. Awareness badh rahi hai. Opportunity bhi badh rahi hai.

Yet myths continue to hold people back.

Let’s clear them – calmly, honestly, and respectfully.

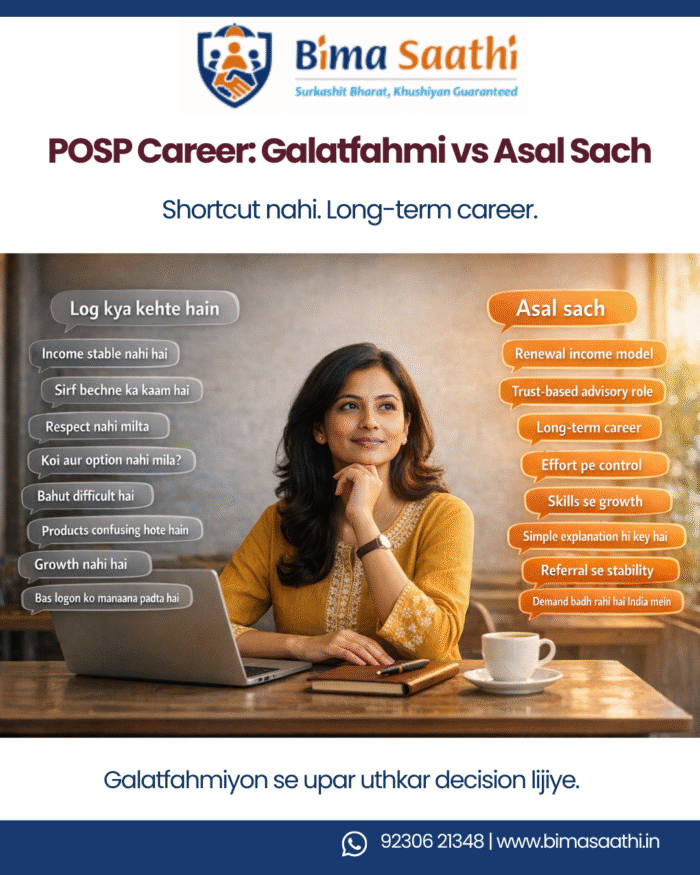

Myth 1: “Insurance agent career has no stable income.”

The Truth: It depends on skill, consistency, and network – not luck.

Yes, insurance is performance-linked. It is not a fixed salary job.

But let’s compare with reality:

- Small business owners also don’t have fixed salaries.

- Real estate agents don’t have fixed salaries.

- Freelancers don’t have fixed salaries.

Yet, many earn extremely well.

According to industry estimates:

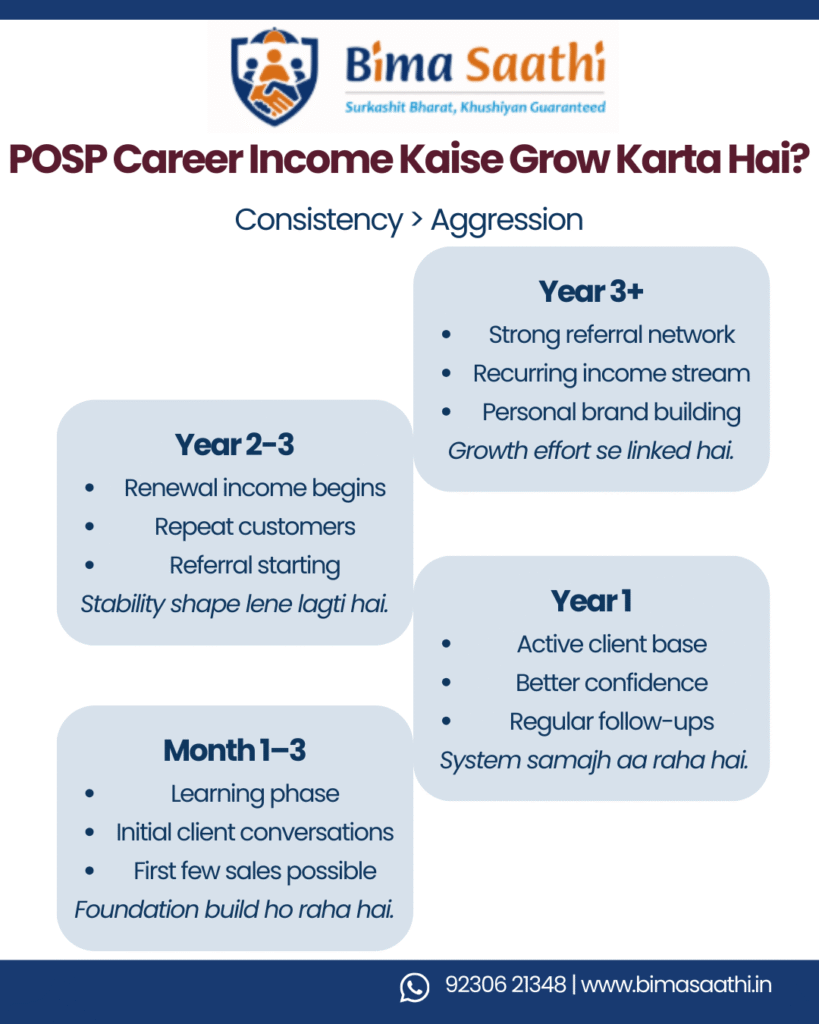

- Entry-level POSPs may earn ₹8,000 – ₹25,000 per month in initial months (depending on effort and network).

- Consistent performers with 2 – 3 years of disciplined activity can build monthly earnings ranging from ₹40,000 to ₹1 lakh+.

- Renewal commissions create recurring income – something many jobs don’t offer.

Is it guaranteed? No.

Is it possible? Yes – with structured effort.

Income unstable nahi hota. Effort unstable hota hai.

Insurance rewards consistency more than aggression.

Myth 2: “Only very extrovert or pushy people succeed.”

The Truth: Listening skills matter more than talking skills.

There’s a stereotype – insurance agents are loud, convincing, over-smart salespeople.

Reality check?

Insurance is about trust. And trust is built by:

- Listening

- Explaining clearly

- Being patient

- Following up respectfully

In fact, research in consultative sales globally shows that top-performing advisors talk less than 50% of the time in customer conversations.

Customers today don’t want pressure. They want clarity.

“Sir bas sign kar dijiye” approach no longer works.

What works?

- “Aapki situation samajh lete hain.”

- “Yeh plan sabke liye perfect nahi hota.”

- “Decision aapka hai.”

Insurance mein awaaz se zyada niyat sunai deti hai.

If you are calm and trustworthy – you already have an advantage.

Myth 3: “Insurance agent career is only for people who couldn’t get other jobs.”

The Truth: It is increasingly becoming a structured professional path.

Earlier, entry barriers were low and training inconsistent. That created a perception problem.

Today, the ecosystem is changing.

- Mandatory certification exams

- Digital onboarding

- Structured product training

- CRM systems

- Online policy issuance

- Regulatory oversight

India has over 3 million insurance agents across life and general insurance sectors. Many are:

- Graduates

- Former bankers

- Retired PSU employees

- Chartered accountants

- Homemakers building financial independence

In fact, many retired bank professionals join insurance advisory because:

- They value trust-based roles.

- They enjoy advisory conversations.

- They want supplementary income with relevance.

This is not a “last option” career.

It is a relationship-driven advisory profession.

Yeh backup plan nahi hai. Yeh long-term play hai.

Myth 4: “Insurance agent career has no respect.”

Let’s pause here.

Respect doesn’t come from job title.

Respect comes from responsibility.

Think about this:

If something happens to a family’s earning member, and because of your guidance:

- Children’s education continues,

- Home loan EMIs are paid,

- Medical emergency is covered,

Will that family forget you?

Insurance is invisible when everything is fine.

But it becomes priceless during crisis.

According to industry data:

- India sees over 10 million hospitalisations annually in the private sector.

- Medical inflation is running at 12 – 14% per year.

- A single critical illness can cost ₹5 – 20 lakhs in urban India.

When families face such situations, a responsible advisor is not “just an agent.”

They are remembered.

“Usne time pe samjhaaya tha.”

Respect may not come instantly.

But it comes deeply.

Myth 5: “It’s all about convincing people forcefully.”

The Truth: Ethical selling wins long-term.

Old-school insurance selling often relied on:

- Fear

- Urgency

- Emotional manipulation

But that approach damages:

- Reputation

- Referrals

- Renewals

- Mental peace

Modern insurance advisory focuses on:

- Need discovery

- Clear explanation

- Balanced benefits

- Limitations acknowledgement

- Customer decision ownership

And here’s something practical:

Nearly 60 – 70% of quality business in insurance comes through referrals and repeat customers.

Forceful selling kills referrals.

Guided decisions build referrals.

Short-term pressure se sale mil sakta hai. Long-term trust se career banta hai.

Myth 6: “It’s too difficult. Products are confusing.”

Yes, insurance products are complex.

But so are:

- Tax rules

- Stock markets

- Loan agreements

- Medical reports

That’s exactly why advisors exist.

The real skill is not memorising brochures.

It is simplifying concepts.

When you can say:

- “Term plan simple protection hai.”

- “Health insurance medical kharch ka safety net hai.”

- “Har plan sabke liye sahi nahi hota.”

You are already doing the core job.

Insurance education in India is increasing. Platforms are digitising. Training models are improving.

Skill is built step-by-step.

No one is born knowing policy wordings.

Sab seekhte hain. Dheere dheere.

Myth 7: “There’s no growth in insurance agent career in India.”

Let’s look at macro trends:

- India’s middle class is expected to reach 500+ million people by 2030.

- Health awareness has increased significantly post-COVID.

- Government schemes have increased insurance familiarity.

- Digital payments and e-KYC have simplified processes.

Insurance penetration in rural and semi-urban India is still significantly underdeveloped.

Which means?

Opportunity runway is long.

Unlike saturated job markets, advisory demand grows as incomes grow.

And remember – this profession scales with:

- Network expansion

- Knowledge depth

- Referral chain

- Renewal base

Your past work compounds.

That is powerful.

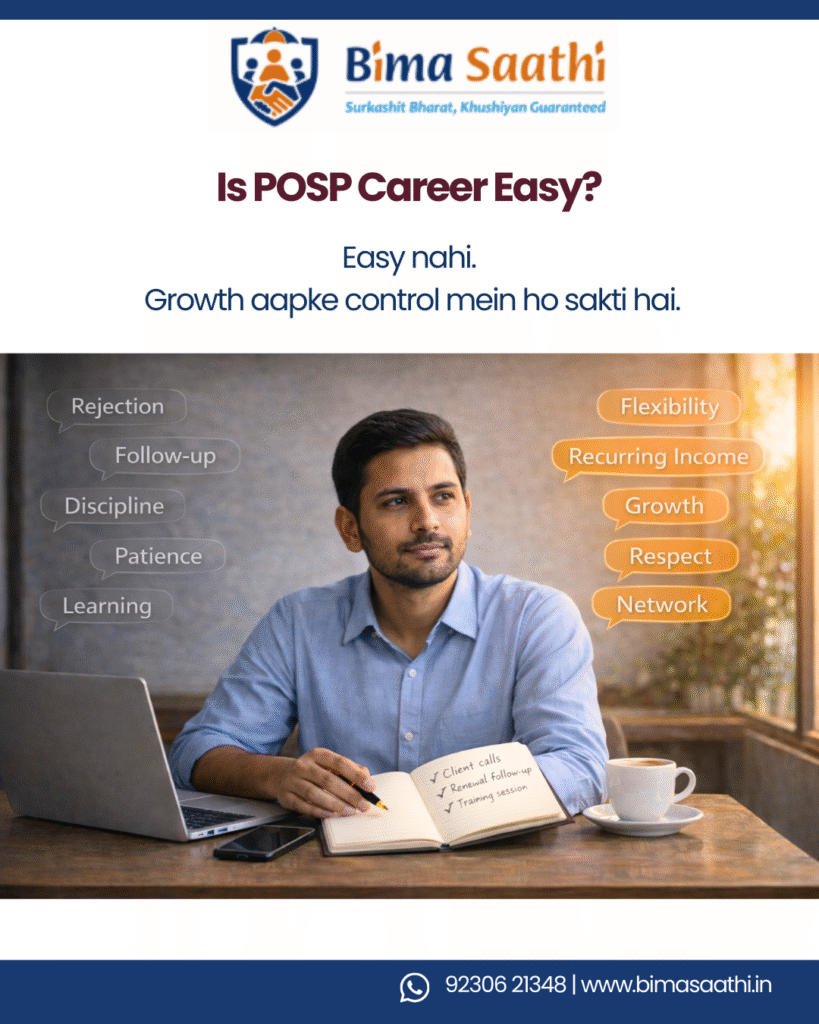

The Real Picture: Is Insurance Agent Career Easy?

No.

Let’s be honest.

It requires:

- Rejection handling

- Emotional discipline

- Follow-up patience

- Ethical backbone

- Continuous learning

But here’s the flip side:

It offers:

- Flexible time

- Unlimited earning potential (effort-linked)

- Respect through responsibility

- Recurring income

- Local network-based growth

- Personal brand building

Mehnat toh har jagah hai.

Difference sirf itna hai –

Yahan growth aapke control mein zyada hoti hai.

Who Should Consider Insurance Agent Career in India?

You should seriously consider it if:

- You value relationships over transactions.

- You want flexible earning options.

- You live in Tier II / Tier III areas where trust networks are strong.

- You are comfortable learning gradually.

- You want supplementary income without heavy capital investment.

- You believe in long-term stability over quick wins.

It may not suit you if:

- You want fixed salary comfort only.

- You avoid conversations.

- You expect instant results.

- You dislike learning financial concepts.

There is no shame either way.

Clarity is empowerment.

Final Thought

Insurance agent career in India is not glamorous.

It is not flashy.

It is not viral on Instagram.

But it is meaningful.

And meaningful careers quietly outlast trendy ones.

Log shayad aaj na samjhein.

Kal yaad zaroor karte hain.

If you’re evaluating this path, don’t listen to myths.

Understand the model. Assess yourself honestly.

Then decide with confidence.

Because at the end of the day –

Career wahi sahi hota hai jisme growth bhi ho, dignity bhi ho, aur neend bhi shaanti se aaye.

हिंदी में पढ़ें

Frequently Asked Questions

Q1. Is insurance agent career in India profitable?

Yes, it can be profitable with consistent effort, strong relationships, and ethical selling. Income depends on performance, not fixed salary structure.

Q2. How much can an insurance agent earn in India?

Earnings vary widely. Beginners may earn ₹10,000 – ₹25,000 monthly, while experienced agents with renewal income can earn ₹50,000 to ₹1 lakh+ per month depending on network and effort.

Q3. Is insurance agent a stable career option?

It can be stable if you build a renewal base and referral network. Stability comes from consistency, not from guaranteed salary.

Q4. Do I need prior experience to start insurance agent career in India?

No prior experience is mandatory, but you must complete required certification and undergo training. Skills can be learned step-by-step.

Q5. Is insurance selling difficult in Tier II and Tier III cities?

It requires trust-building, but strong community networks in Tier II and Tier III cities can actually support long-term growth if approached responsibly.

Leave A Comment